Intro

While health and auto insurance primarily protect you, long-term care insurance (LTCi) offers significant protection for your family as well.

Remember when a famous family, the Griswolds, drove across the country in a station wagon to visit Wallyworld, only to discover that it was closed for repairs? If you missed it, here's a 30-second clip.

Family is important and you should remember them as you plan for your long-term care. But they're not the only reason to get LTCi. This decision also affects your care and savings.

Long-term care insurance may be important in your LTC goals: Learn about options, Talk with family, and Create a plan.

Post jargon

caregiver: provides direct, hands-on assistance with daily LTC

care manager: coordinates and oversees care services without direct caregiving

cash indemnity: pays the full benefit, regardless of the actual care costs

CCRC: continuing care retirement community; housing with many LTC services

LTC: long-term care

LTCi: long-term care insurance

respite care: ("res-pit") short-term senior care to provide relief for caregivers

senior community: housing providing long-term care for older adults, often with shared activities

➡️ Explore all the LTC jargon

For families

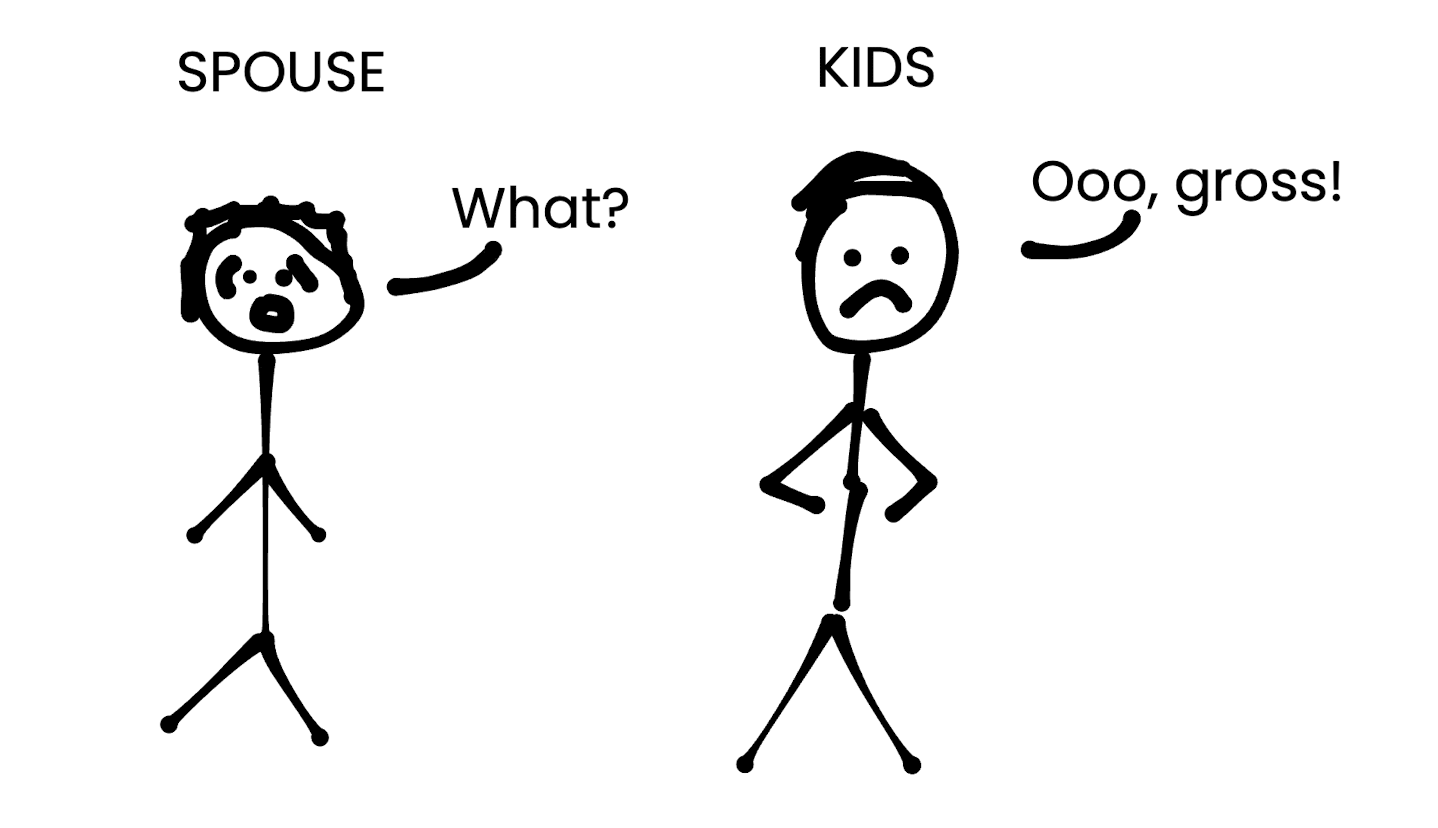

Long-term care doesn’t just affect the person who needs it—it deeply impacts their family as well. It's important to consider who often takes on the heavy lifting: spouses and kids.

Even with unconditional love, helping someone with everyday tasks—like getting out of the bathtub—can take a significant toll. Every. Single. Day.

Close your eyes and try to imagine it. 😗

Families care deeply for one another, but caregiving is a 24/7 responsibility that can create emotional, physical, and financial challenges. Planning ahead can help ensure that the caregiver’s and the care recipient’s needs are supported.

Check out the 'Caregiver Support' community on Reddit, where you'll find stories of how caring for aging parents quickly becomes physically and emotionally overwhelming.

Click "read more" on this Reddit post for a first-hand account of the challenges of caregiving.

Do people actually understand?

by u/stopthevan in CaregiverSupport

Family caregivers have limitations.

- When someone needs care, their family might not be around. Their spouse may pass away, and their kids may move to Austin for a job.

- A caregiving role is much bigger than helping with a cold. They may not know how to provide adequate care. Professionals are trained with many caregiving skills and certified to be in-home caregivers.

If a family member is the caregiver, many LTCi policies can still help.

- Benefits can pay for respite care or adult daycare to provide breaks. A policy with cash indemnity. can even pay family members for care.

- LTCi enables a family member to act as a care manager rather than a hands-on caregiver by covering the cost of professional care. Family members can focus on coordinating care without the physical demands.

For care recipients

Think about a long airline flight—would you choose a cramped discount airline or one with comfortable seats and decent meals? Long-term care can feel like a long journey, but with the right planning, it can be much smoother for everyone involved. A little preparation now means your future self—or your loved ones—will be able to say, "Thanks."

Stay at home - 79% of adults prefer staying in their homes as long as possible. LTCi provides flexibility to maintain independence by covering paid health aides or paying for home modifications to make living at home easier.

Join a senior community – If a Continuing Care Retirement Community (CCRC) or similar senior community is a better fit, LTCi can help make that transition more affordable and accessible.

LTCi helps protect against large, unexpected costs, giving you or your family the freedom to focus on what matters most instead of worrying about financial burdens.

For savings

A lifetime of hard work goes into building a nest egg, whether it’s yours or a loved one’s. Don’t let unexpected LTC costs put that at risk.

- Leverage - With LTCi, every dollar you spend typically buys 3x-5x the coverage immediately. For example, $100k in premiums could turn into $300k to $500k in coverage immediately. Plus, you get the added bonus that LTCi benefits are tax-free.

- Retirement security – Long-term care costs are one of the biggest threats to retirement savings. Having a plan ensures the savings you or your loved ones worked hard for are preserved for the things that matter most.

- Spousal support - Without proper planning, LTC expenses could drain savings, leaving a spouse with little to live on. Dave Ramsey describes this situation in this 30-second clip.

- Family legacy - Planning ahead means leaving the next generation in good financial shape, not burdening them with bills for care.

Wrap up

As you or a loved one gets older, don’t let long-term care needs leave the family stranded in the Wallyworld parking lot. LTCi can help maintain control, prevent loved ones from becoming overwhelmed, and protect savings for the future.

At a minimum, create a plan and have an open conversation with your family about care needs.