Intro

Before you can buy long-term care insurance, you’ll need to get through underwriting. Think of it like Patrick Swayze in Road House—the bouncer who only lets the right people in.

Even if you’re ready to buy a policy, the insurer might turn you away if your health doesn’t meet their standards. They only want to cover the healthiest folks to keep their costs down.

And if you’re feeling inspired by another Patrick Swayze classic, you might be tempted to show off your best Dirty Dancing moves to prove your fitness. Unfortunately, this is not a common evaluation metric by insurers.

Remember to use the letters LTC as a guide to achieve these goals: Learn about options, Talk with family, and Create a plan. Reviewing your health with underwriting in mind should be one of your first steps to understanding what options are available to you.

Post jargon

benefit: the amount LTCi pays for covered care expenses

claim: a request for benefits when LTC is needed

LTC: long-term care

LTCi: long-term care insurance

NAIC: National Association of Insurance Commissioners; sets standards for state insurance regulation

preexisting condition: an illness treated before applying for LTCi

premium: the payment to maintain insurance

➡️ Explore all the LTC jargon

What is it?

Underwriting is when the insurance company checks your health to decide two things:

- whether they want to offer you a policy

- how much it will cost

You're being evaluated.

Your health is the biggest factor in your chance to get coverage. Insurers cherry-pick healthy applicants to reduce costs and keep premiums affordable for others.

Long-term care underwriters try to forecast if you'll need care and for how long. Conditions like Alzheimer's, which may require care for 10-20 years, are of greater concern than conditions like pancreatic cancer, which often progresses quickly.

The underwriting process differs for every insurer and changes frequently, but below are some general concepts that apply to most.

Pre-qualification

You should avoid being officially declined during underwriting, as this can raise a red flag on future applications with other insurers.

At Long Term What? we recommend doing a pre-qualification check. It helps spot any red flags before you submit your official application, saving you from a possible decline down the road.

We provide two pre-qualification options:

- Quick check - We have access to the underwriting guidelines of most insurers (often 10 pages long). While we can’t post them publicly, we can quickly compare your medical conditions and prescriptions to their requirements.

- Thorough check - Fill out a confidential health history form for a third party or insurer to review and provide feedback.

In the pre-qualification, you may discover:

- Whether you're likely insurable or uninsurable

- Which insurer is most likely to issue a policy

- If you should wait 6-12 months until a health issue is resolved

Pre-qualification results do not count as a declined application.

Application

When applying for a policy, you’ll be asked basic questions such as your age, smoking history, height, and weight.

Below is a sample chart of allowable weight ranges based on height. Remember that each insurer has different guidelines, and exceptions may be made in certain cases (e.g., for weightlifters).

| Height | Male (lbs) | Female (lbs) |

|---|---|---|

| 5'0" | 97-199 | 87-199 |

| 5'2" | 104-213 | 93-213 |

| 5'4" | 110-227 | 99-227 |

| 5'6" | 118-241 | 105-241 |

| 5'8" | 125-256 | 112-256 |

| 5'10" | 132-271 | 118-271 |

| 6'0" | 140-287 | 125-287 |

| 6'2" | 148-303 | 132-303 |

| 6'4" | 156-320 | 139-320 |

| 6'6" | 164-337 | 147-337 |

You’ll also be asked more detailed questions, such as:

- Have you had any surgeries in the past 10 years? If so, what were they and when did they occur?

- Are you currently taking any prescription medications? If so, what are they, and what conditions are they treating?

- Does anyone in your family have a history of cognitive impairments, such as Alzheimer’s?

- Do you have any difficulty performing activities of daily living (ADLs), like bathing, dressing, or eating?

What they check

After you submit your application, the insurer may review your health records, prescription history, and other relevant information. To save time and costs, insurers only use the necessary underwriting tools to assess your risk. For instance, only 60% of applicants receive a phone interview.

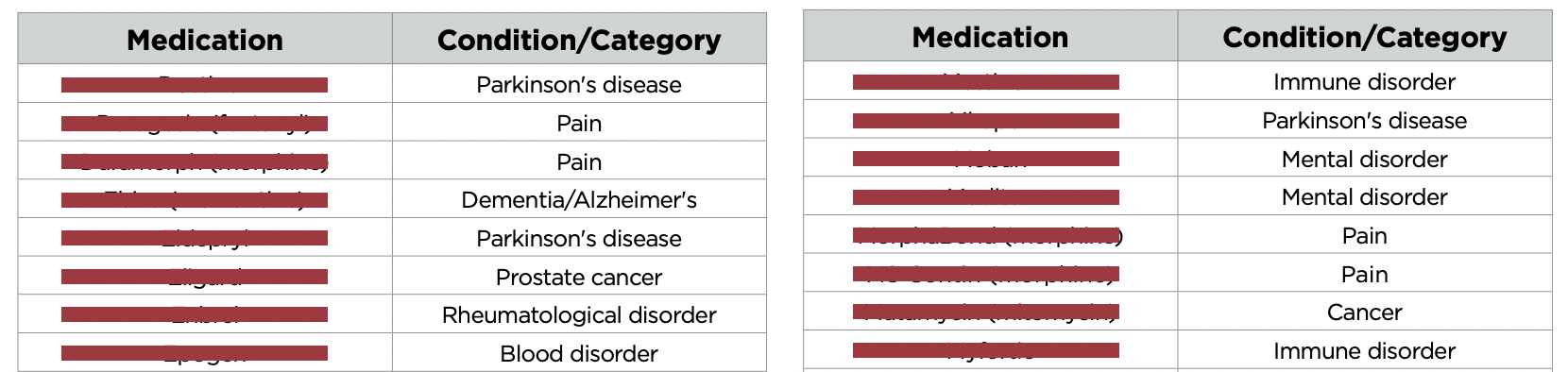

Prescription history - Insurers access large databases containing prescription records from health insurers and pharmacies. After applying for insurance, you can request your report to ensure its accuracy.

Medical records - The insurer may request records from your primary care doctor and any specialists you've visited.

Phone interview - A nurse might conduct a phone interview to ask follow-up questions about your application, prescriptions, or medical history.

MIB - The Medical Information Bureau (MIB) maintains a database that insurers use to verify your health information. You can request this report after applying to check for any errors.

Cognitive testing - For applicants over 65, some insurers require a phone-based cognitive test. You may be asked to recall words, count backward by sevens, or spell simple words in reverse. These tasks assess memory, attention, and processing speed.

In-person exams - Some insurers also require a face-to-face exam for applicants over 65 to further assess their ability to live independently.

Red flags

Insurers are on the lookout for high risks that suggest you may need LTC for an extended period.

Knockout issues

If you currently require long-term care due to a cognitive condition (e.g., Alzheimer's) or difficulty with activities of daily living (e.g., bathing, transferring), you likely won’t be eligible. You can't buy fire insurance if your house is already on fire.

Many insurers will likely deny pre-existing conditions like current cancer, kidney disease requiring dialysis, mobility issues, oxygen use, paralysis or spinal cord injury, Parkinson's disease, schizophrenia, stroke with limitations, uncontrolled diabetes, or severe mental illness.

Gray areas

Human bodies are complicated.

Some conditions may not immediately disqualify you but could still impact your eligibility based on a combination of factors or unresolved issues:

- One condition (e.g., diabetes) might be acceptable, but two related conditions (e.g., diabetes and a BMI over 35) could raise concerns.

- Upcoming or recent surgeries (within the last 12 months)

- Recent physical therapy

- Pending tests or lab work with unresolved results

Family health history

While your personal health history is more important, certain red flags in your family history—such as early-onset dementia, Huntington's disease, ataxia, or polycystic kidney disease—can still raise concerns.

However, each insurer evaluates risk differently, so don't give up. You never know.

At Long Term What? we can help you choose the best insurer based on your personal or family health history.

Rate classes

If you're approved, you'll often be assigned a rate class based on your level of risk. The names may vary, but typically they include:

- Preferred

- Standard

- Sub-standard

Getting into the ‘preferred’ class means you’ll get a better policy—either a lower price or more benefits—compared to folks in the standard or sub-standard classes.

Odds of decline by age

Long-term care insurance underwriting typically has a cut-off age, usually around 75. The older you are when you apply, the higher the chances of being declined.

This chart shows declines for those who apply. Many don't even bother to apply due to existing conditions.

So apply early.

Underwriting time

After applying, you can expect a response within 60 days, though some insurers offer streamlined underwriting that may deliver results in just a few days.

If you're declined, you can usually request a specific reason and may have the opportunity to appeal.

Post-claim underwriting

If an insurer approves your application, can they revisit it and deny your claim 20 years later?

Thankfully, no. The National Association of Insurance Commissioners (NAIC) prohibits post-claim underwriting to protect consumers, and these regulations are enforced in most states.

Most LTC policies have a contestability period—typically two years—during which insurers can deny claims if you unintentionally omitted details, like a minor medical condition. After this period, unintentional errors can’t be contested.

With that said, don't cheat.

But if you intentionally mislead the insurer (e.g., lied about your medical history), there’s no time limit. That’s insurance fraud.

Wrap up

Underwriting can feel like trying to get past a strict bouncer, but with the right preparation and some help from us, you’ll know just what to expect. We’ve got your back through the entire process.