Intro

When it comes to long-term care insurance (LTCi), you have a choice between two contenders in a race for your long-term care needs: traditional policies and hybrids.

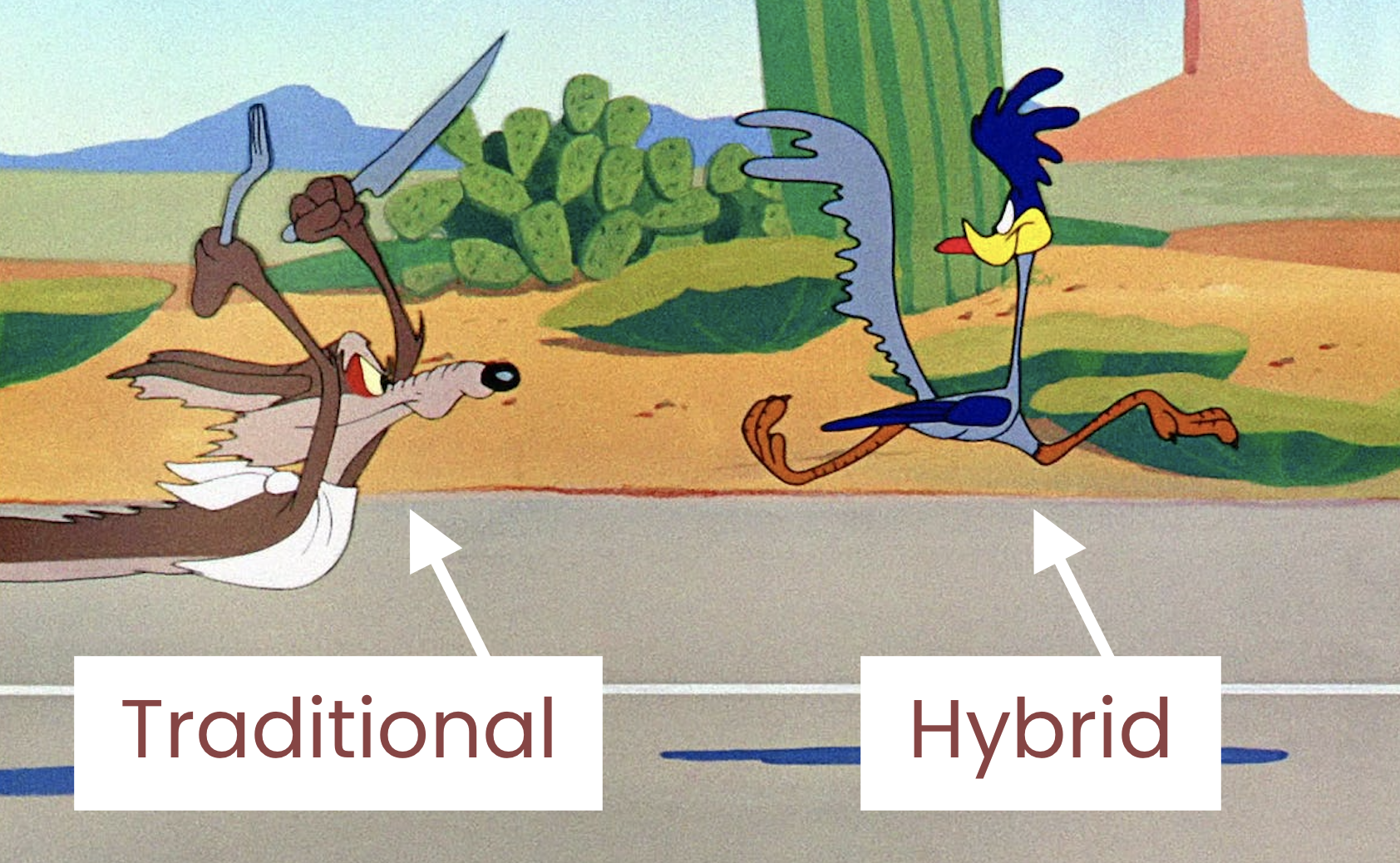

Remember those Saturday morning cartoons where the Coyote tries to drop an anvil on the Road Runner, but the rope snaps, and the anvil crushes him instead?

Let’s compare traditional policies to Wile E. Coyote, who always seems one step behind his rival, the Road Runner. No matter how many new gadgets or traps he tries, the Coyote just can’t catch up.

Like Wile E. Coyote, traditional policies have faced setbacks, such as premium hikes, and are slow to adapt, often sticking with rigid reimbursement models.

However, traditional policies still have their place. They offer some advantages that hybrids don’t, such as better tax benefits and lower costs. While hybrids offer more flexibility, traditional policies keep trying to catch up.

For a short lesson in cartoon physics, check out this 30-second clip.

Remember to use the letters LTC as a guide to achieve these goals: Learn about options, Talk with family, and Create a plan. Choosing between traditional and hybrid LTCi is an important step in reaching these goals.

In this post, we’ll explore how traditional policies compare to hybrids and how, despite some drawbacks, they could still be the best fit for you.

Post jargon

ADLs (activities of daily living): basic tasks like bathing, dressing, eating, transferring, toileting, and continence

benefit: the amount LTCi pays for covered care expenses

death benefit: a payout to a beneficiary from a hybrid policy after the insured passes away

exclusion: an insurance rule that denies benefits for specific risks

LTC: long-term care

LTCi: long-term care insurance

partnership policy: a special LTCi policy to keep assets from MedicAID

premium: the payment to maintain insurance

➡️ Explore all the LTC jargon

What is it?

Traditional LTCi started in the 1960s and has some fundamental features across almost all policies, even today. We'll describe these features to see if they're losing to, catching up with, or beating hybrids.

Losing to hybrids

Reimbursement

Traditional policies reimburse policyholders for their LTC expenses, similar to how your homeowner's insurance works.

| Type | Benefit criteria | Benefit |

|---|---|---|

| Home insurance | House floods | Get $ for new floors |

| Traditional LTCi | Need help with 2 ADLs | Get $ for assisted living |

This payment method means policyholders must submit receipts and often receive less than the maximum benefit amount (though they may recover the difference later).

More exclusions

Since traditional LTCi reimburses for care, they often have more exclusions than hybrids to limit coverage for unrelated costs. For instance, they often don't cover payments to family members acting as caregivers.

No cash value

Traditional policies, often called pure LTCi, are like renting a home—you pay for benefits but don’t have any equity or value in the contract.

Traditional policies lag behind hybrids due to reimbursements, exclusions, and no cash value, so they must be innovative to stay competitive.

Fortunately, traditional policies have been catching up.

Catching up with hybrids

Rising annual premiums

For most traditional LTCi policies, you pay yearly premiums that can go up over time. But now, some newer policies offer "guaranteed premiums," so your payments cannot increase.

OK, so this improvement gets traditional policies to a tie with hybrids.

"Use it or lose it"

A common drawback of traditional LTCi is that if you don't use your benefits, you lose the premiums you've paid. But now, a few policies offer an expensive paid add-on that returns your premiums to your family if you don’t use them.

OK, I guess we're at another tie for this benefit.

If we're keeping score of how traditional LTCi compares to hybrids so far, they're losing in some areas but catching up in others.

| Benefit | Compared to hybrids |

|---|---|

| Reimbursement | Losing |

| More exclusions | Losing |

| Rising annual premiums | Catching up |

| Use it or lose it | Catching up |

Beating hybrids

Tax advantages

Traditional LTCi often provides better tax benefits because it's considered "pure" LTCi. In many cases, the full premium can be deducted.

Partnership policies

Partnership policies are a special arrangement between states and private LTC insurance companies to help protect your savings if you need long-term care.

Here’s how it works. Normally, if you don’t have insurance—or if your care costs are higher than what your insurance will cover—you might need to turn to MedicAID. But to qualify for MedicAID, you’d have to “spend down” your savings—using up almost everything you have—before receiving help.

With a partnership policy, the rules are different. Every dollar your policy pays for care lets you keep a dollar of your savings. You don’t have to spend that money to qualify for MedicAID. For example, if your policy pays out $100,000 in benefits, you can still keep $100,000 in your bank account and qualify for MedicAID when your insurance runs out. This is allowed because of the special deal behind the partnership program.

Why does this matter? It means you can protect more of your savings to leave to your family when you pass away, instead of using it all for care costs.

Even if you move to another state, most will still honor this arrangement.

So traditional plans have some advantages, but we still... want... more.

Lower cost

Traditional LTCi is often less expensive than hybrids. Let's dig in.

The costs

The biggest reason people might choose traditional LTCi over hybrid policies is the lower cost—or more benefits for the same cost. Let’s break it down.

Costs and benefits for LTCi depend on the insurer, your health, and other factors. With that in mind, here’s a side-by-side comparison for a healthy 55-year-old non-smoker in Colorado with a 6-year policy and 3% compound inflation protection:

| Traditional LTCi | Hybrid LTCi | |

|---|---|---|

| One-time premium | $3,600/yr for life | $5,500/yr to age 100 |

| Benefits at age 85 | $1,040,000 | $1,040,000 |

| Death benefit | $0 | $130,000 |

In this example, the traditional policy is less expensive for similar benefits at age 85, while the hybrid provides money to your family if the benefits aren’t used.

Comparing traditional vs. hybrid policies is difficult. It's like comparing a camera to an iPhone.

Both take photos, but an iPhone does much more—it's also a phone, browser, and GPS.

Similarly, both LTC policies pay for long-term care, but a hybrid does much more—it adds cash payouts (indemnity) with fewer exclusions plus death benefits, as we previously discussed.

Traditional LTCi examples

Check out traditional LTCi reviews from Long Term What? with star ratings.

Wrap up

Traditional policies, like Wile E. Coyote, have had their setbacks, but they remain determined and keep trying new things.

That said, if you're looking for straightforward LTC coverage at the lowest cost, traditional plans could be the better option.

With various policies and benefits available, we can help you find the best solution for your needs.