Intro

Uncle Sam offers some tasty tax breaks for buying long-term care insurance (LTCi)—in fact, they can be better than what you’d get with IRAs or 401(k)s.

Every tax break won't work for you, but think of them like a spread at a fancy dinner—there are plenty of options, even if you don’t take a bite of everything. You might not use every deduction, but you’ve got a buffet of options to choose from.

If you haven't seen A Christmas Story since last December, you might enjoy this 30-second clip.

Remember to use the letters LTC as a guide to achieve these goals: Learn about options, Talk with family, and Create a plan. Understanding your true costs of buying LTCi after your tax savings will help you with your plan.

Post jargon

HIPPA: that privacy law you hear about at your doctor’s office

hybrid: newer LTCi combining life insurance with LTC benefits

LTC: long-term care

LTCi: long-term care insurance

MedicAID: healthcare public assistance

traditional policy: early LTC insurance referred to as "pure" LTCi

➡️ Explore all the LTC jargon

Special tax breaks

Long-term care insurance is the only vehicle, besides HSA accounts, where some or all of your:

- premium (what you pay) can be tax-deductible

- benefits (what you get) are received tax-free

You get a special tax break on your money going both in and out. 🎉

Most other tax-qualified products, like an IRA or Roth IRA, only offer a tax break for money coming in or out, but not both. LTCi tax breaks are special.

Important point

While benefits are generally tax-free, the tax treatment of premiums depends on your specific situation.

To reinforce this important point using bullet points and emojis:

- Benefits: Received tax-free by nearly everyone. 🥳

- Premiums: Tax treatment varies based on your specific situation. 🤔

We'll dive into these nuances of premium tax breaks throughout the rest of this post.

Why the tax breaks?

In 2020, MedicAID spent over $200 billion on long-term care, which accounted for 34% of all MedicAID spending.

LTC is a huge cost to the government, and they want someone else to foot the bill.

To get someone else to pay, they've tried several tactics.

- LTC partnership plans

- State programs like Washington Cares

- Tax breaks to buy long-term care insurance ⬇️

What LTCi is best for tax breaks?

All the policies we sell are tax-qualified for tax-free benefits, but the eligibility for premium tax breaks varies on the type of policy.

Traditional LTCi

Since traditional policies are "pure" LTC insurance, the full premium may be tax-deductible.

Hybrid LTCi

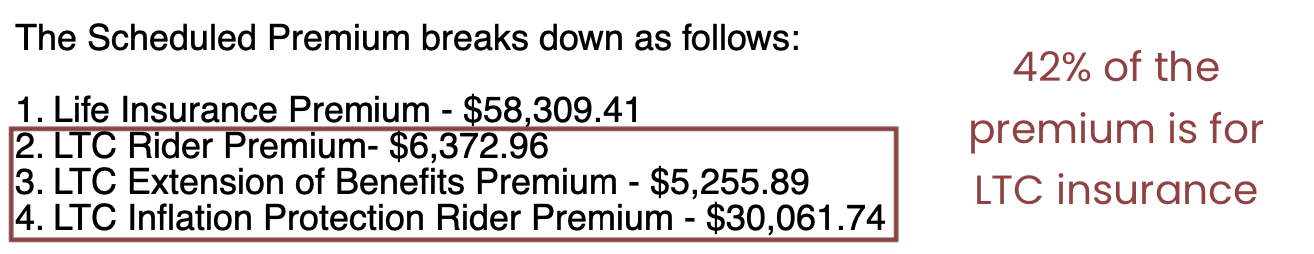

Hybrids combine life insurance and LTC insurance, so only the LTC portion of the premium gets tax breaks. Uncle Sam doesn't offer tax deductions on life insurance premiums.

Some hybrids provide separately identifiable life and LTC premiums. These include:

- OneAmerica Asset Care

- Securian SecureCare III

- Nationwide CareMatters II

- Nationwide CareMatters Together

- Lincoln MoneyGuard Fixed Advantage

For example, if you spent $100k on this example hybrid policy, 42% of the premium is allocated to LTC and potentially deductible.

Using existing investments to fund LTCi

Many people choose to fund long-term care insurance (LTCi) using their existing investments, maximizing tax advantages and making their assets more efficient.

These investments generally fall into two categories:

| Type | Description | Examples |

|---|---|---|

| Non-qualified | Made with after-tax dollars; Grow tax-deferred for some | Whole life insurance, Non-qualified annuities |

| Qualified | Made with pre-tax dollars; Grow tax-deferred | 401(k), 403(b), IRA SEP IRA, Pension plans |

Non-qualified investments (1035 exchange)

A 1035 exchange, lets you move funds from a life insurance policy or annuity into an LTCi policy tax-free, turning an underused asset into long-term care coverage.

- Option 1: Keep your investment – If you withdraw funds from a life insurance policy or annuity worth $150k when you originally paid $100k, the $50k gain is taxed as income.

- Option 2: Transfer to LTCi – A 1035 exchange moves the full $150k into an LTCi policy, avoiding taxes on the $50K gain, and future LTC benefits are also tax-free.

Since taxes were already paid on the original premiums, a 1035 exchange avoids extra taxation, making it just as tax-efficient as buying LTCi upfront.

Qualified investments

OneAmerica’s Asset Care policy uniquely allows you to use qualified funds—like those from a 401(k) or IRA—to purchase LTCi coverage directly.

Fireworks

Are your eyes glazing over with all this tax-speak? These fireworks might help.

Who qualifies?

If you're paying for LTCi premiums out-of-pocket rather than transferring funds from an investment, premium tax breaks depend on who pays for the policy.

Individuals (so-so)

If you’re buying long-term care insurance on your own, you may be able to deduct the premiums if you can jump through three hoops:

- ✅ Medical expense threshold: Your total medical expenses, including LTC premiums, must exceed 7.5% of your annual income (AGI), and only the portion above this threshold is deductible.

- ✅ Itemized deductions: You must itemize your deductions instead of taking the standard deduction.

- ✅ IRS premium caps: Your annual premium must be below IRS caps based on your age.

| Age | 2025 premium limit |

|---|---|

| ≤ 40 | $480/yr |

| 41-50 | $900/yr |

| 51-60 | $1800/yr |

| 61-70 | $4810/yr |

| 71+ | $6020/yr |

Self-employed business owners (better)

If you're self-employed (like an LLC or S Corp owner), you can deduct LTCi premiums using the Self-Employed Health Insurance Deduction, which lowers your taxable income.

You can skip two of the three hoops entirely.

- ❌ Medical expense threshold

- ❌ Itemized deductions

- ✅ IRS premium caps: Even though two hoops are skipped, IRS premium caps still limit deductible amounts.

As an added perk, the entire premium amount paid by an S-Corp for a >2% shareholder-employee is exempt from FICA.

C corporations (best)

Your company can cover the full cost of your LTCi premiums and deduct it as a business expense with no age-based limits, as long as it is considered reasonable compensation.

In this case, none of the three hoops apply.

- ❌ Medical expense threshold

- ❌ Itemized deductions

- ❌ IRS premium caps

This can be especially helpful for hybrid policies with their higher upfront premiums, but you should make sure these costs meet the necessary requirements for deductibility.

State tax benefits

Many states offer deductions or credits if you buy long-term care insurance. These perks vary, but they usually align with federal tax rules and encourage you to rely on LTCi for future care instead of state-funded programs.

Wrap up

Long-term care insurance comes with several tax breaks, but like any fancy dinner, there are limits to what you can enjoy. The IRS has its usual conditions, so be sure to know what’s on the menu. But with the right strategy, you can savor some serious savings and leave feeling full and satisfied. 😉