Intro

Mutual of Omaha is a well-known brand, thanks in part to their iconic sponsorship of the beloved wildlife series Wild Kingdom, which began in 1963.

MutualCare, their individual traditional policy, stands out in a crowded market thanks to:

- Lots of options: Tailor coverage to your needs.

- Shared care: Extend more benefits to your partner.

- More tax savings: Reduce your overall costs.

This policy is offered in two versions:

- Custom Solution: Highly customizable.

- Secure Solution: Simple and straightforward.

Diving into the Custom Solution might feel like taking the controls of a spaceship. This version is packed with options—picture yourself surrounded by rows of buttons, switches, and screens, each one unlocking a different feature or add-on.

For some, this level of complexity is empowering, offering a fully customizable journey through long-term care insurance.

- If you enjoy exploring every feature in a new app and adjusting every setting, the Custom Solution could be right up your intergalactic alley.

- If you prefer more simplicity, you may find the Secure Solution or another policy to be a smoother ride.

As you consider your options, let 'LTC' be your onboard navigation system: Learn about options, Talk with family, and Create a plan that supports your future trajectory.

Post jargon

benefit: the amount LTCi pays for covered care expenses

benefit period: the maximum time LTCi pays for care after criteria are met

benefit pool: total amount available in LTCi for care expenses

cash indemnity: pays the full benefit, regardless of the actual care costs

death benefit: a payout to a beneficiary from a hybrid policy after the insured passes away

elimination period: the waiting period after criteria are met before benefits start

exclusion: an insurance rule that denies benefits for specific risks

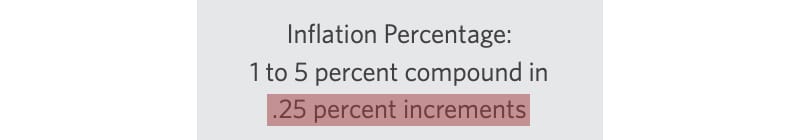

inflation protection: LTCi benefit that adjusts for rising costs

premium: the payment to maintain insurance

rider: an insurance add-on

underwriting: insurer’s review process to decide coverage and cost

➡️ Explore all the LTC jargon

Standard benefits

MutualCare also comes with many standard benefits of modern LTCi policies:

- Guaranteed benefits: Your payouts always match your policy terms.

- Benefit triggers: Coverage starts when you need help with two ADLs or cognitive decline.

- Broad coverage: Includes home health care, adult day care, assisted living, nursing homes, memory care, CCRCs, care coordination, respite care, and hospice.

- Inflation protection (optional): Keeps your benefits aligned with rising costs.

What's special about MutualCare?

In a competitive market, policies often include standout features to set themselves apart. Let’s take a closer look at what makes MutualCare special.

Lots of options

Mutual of Omaha offers two policies that are very similar in price and benefits.

- Custom Solution: Provides lots and lots and lots and lots of customization. For example, have you ever stayed up at night worrying that 2.5% inflation protection is just too much and 2% is just too little? Never. But the Custom Solution offers 2.25% protection.

Other benefit options include Inflation Protection Buy-Up Option, Shared Care, Security Benefit, Joint Waiver of Premium, Survivorship Benefit, Reduced Benefit for Home Health Care and/or Assisted Living Facility...

[pause for deep breath]

...Waiver of Elimination Period for Home Health Care, Professional Home Health Care, Return of Premium, and Nonforfeiture Shortened Benefit Period.

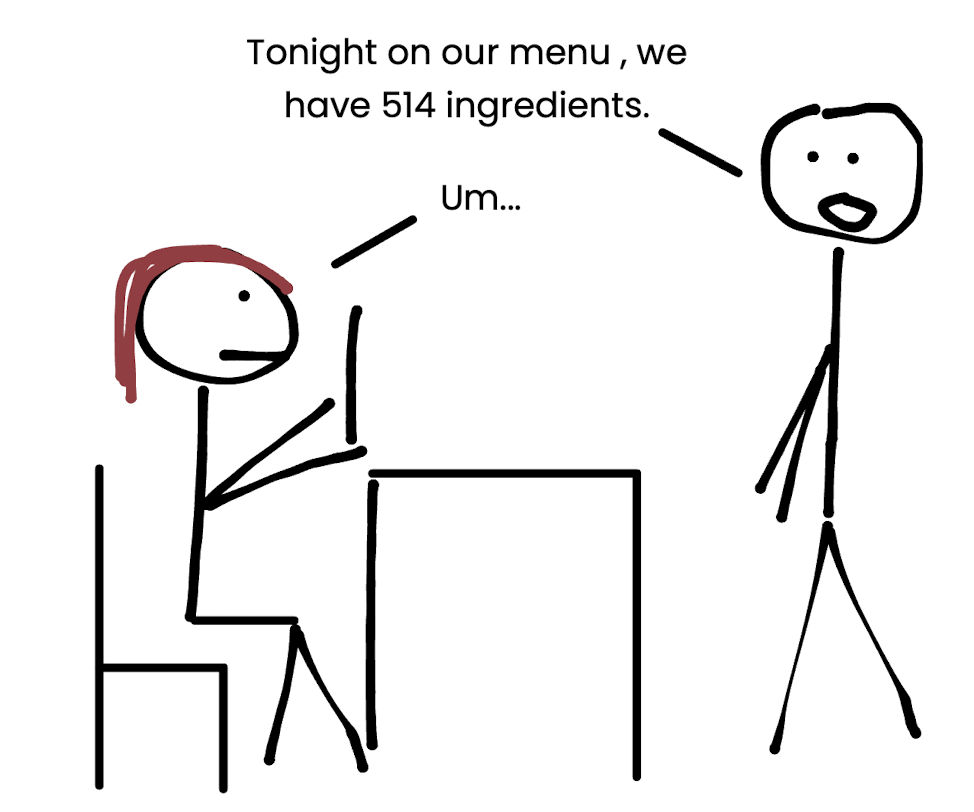

The Custom Solution is like being handed a menu at a restaurant where you're asked to create your own meal.

- Secure Solution: The second policy offers similar coverage with fewer decisions. This version exists because the Custom Solution is so complicated.

If you thrive on having control of every option, we’d be happy to guide you through the Custom Solution. Prefer simplicity? The Secure Solution might be a better fit between the two.

Shared Care

One of the many Custom Solution riders (add-ons) is one called Shared Care. This one can help with the risk of extended long-term care of 10+ years (e.g., Alzheimer’s risk).

Here's how it works

When you and your partner purchase identical policies with the Shared Care rider, your benefits are linked, providing greater flexibility and protection.

- If Partner A exhausts their benefit pool, they can begin using Partner B’s benefits.

- If Partner A passes away, any unused benefits from their policy transfer to Partner B.

- A minimum benefit reserve (typically equal to 12 months of benefits) is preserved for each partner, so neither is left without coverage.

This feature allows you to maximize your combined benefits while ensuring both partners have access to long-term care funds when needed.

So is this good? Yes, but one partner could largely exhaust the other's benefits. But it's still a nice option.

More tax savings

As a traditional policy, MutualCare offers greater tax deduction opportunities. It also qualifies as a partnership policy, which can help protect some of your assets from MedicAID spend-down requirements if you deplete your LTCi benefits.

The details

If this policy sounds intriguing, we'll make sure you land with all the key info.

We rate each policy’s benefits, premiums, underwriting, and company on a three-star scale, with three stars being the best.

Benefits

Benefits are what the policy pays for covered care expenses.

MutualCare offers tons of benefits as extra-cost riders, but the reimbursement payments with limited cash indemnity aren't great.

Premium

Premiums are the payments made to maintain insurance coverage.

Like most traditional policies, you make lifetime payments for MutualCare, with the possibility that rates may increase. While the likelihood of rate hikes is lower than in past decades, it’s still a risk to consider.

Underwriting

Underwriting is how an insurance company evaluates your health and history to determine coverage and pricing.

MutualCare is widely available with a fairly typical underwriting process.

Company

Choose a top-rated insurer for reliable LTC coverage. We work only with financially strong companies to ensure they’ll be there when it counts.

Mutual of Omaha has been around forever and has strong financial ratings.

Comparisons

How does MutualCare compare with other LTCi policies? Focus on what matters most to you to make the best policy choice.

Lifetime premium policies

Most traditional policies use lifetime premium payments, so we’ve compared two side by side to highlight their costs and benefits.

Benefits

In this table, you can compare the benefits of all the LTCi policies we offer. You can:

- Search for any detail.

- Tap any column title to sort.

- Scroll right to view more columns. ➡️

Next steps

If this policy seems like a good fit, take the quiz below and include 'MutualCare' in the notes section at the final step.

Wrap up

In a world of long-term care policies, this one is like a spaceship cockpit—loaded with options, but not for everyone.

This policy is ideal if you want:

- lots of customization options to chart your own course

- the ability to share your benefits with your partner

- solid tax advantages

But keep an eye on two red flags.

- 🚩 Your annual premiums can increase

- 🚩 Reimbursement payments aren’t as flexible as cash indemnity

Overall, this policy offers robust options, but make sure you're comfortable with the potential for rising costs and reimbursement limitations before committing.