Intro

When long-term care insurance (LTCi) was first introduced, it wasn’t perfect. Insurers miscalculated costs, resulting in premium hikes and unhappy customers.

If that sounds familiar, it’s because we’ve seen this play out before—on grocery store shelves.

In 1985, Coca-Cola made headlines when it introduced New Coke, a bold attempt to update the taste of its iconic soft drink for the first time in nearly a century. Check out this 30-second ad introducing New Coke:

The result? A marketing disaster. Public backlash was swift, with angry protests and demand for the original formula. In the end, Coca-Cola brought back the classic taste, rebranding it as Coca-Cola Classic, and the fiasco became a lesson in how not to alienate your customers.

Just like Coca-Cola, the long-term care insurance industry stumbled early on. But they also learned, adapted, and brought smarter, more reliable policies to market—policies that work better for today’s consumers.

We'll dive into the early missteps and the lessons that reshaped LTCi for the better.

Post jargon

benefit: the amount LTCi pays for covered care expenses

LTC: long-term care

LTCi: long-term care insurance

MedicAID: healthcare public assistance

partnership policy: a special LTCi policy to keep assets from MedicAID

premium: the payment to maintain insurance

traditional policy: early LTC insurance referred to as "pure" LTCi

➡️ Explore all the LTC jargon

Brief history of LTCi

Below is a super abbreviated history of LTCi.

Quick timeline

- 1960s - First LTCi policies. 🏛️

- 1980s - Policies were mispriced. ❌

- 1990s - Regulations introduced. ⚖️

- 2000s - Premium increases started. Frustration. 😠

- 2010s - New hybrids launch with cash indemnity. 💡

More details

LTCi emerged in the 1960s with restrictive policies that covered only nursing home care.

By the 1980s, we had neon colors, big hair, and over 100 companies selling LTC insurance like it was the latest hit movie. But just like those perms, things didn’t age well.

Pricing problems

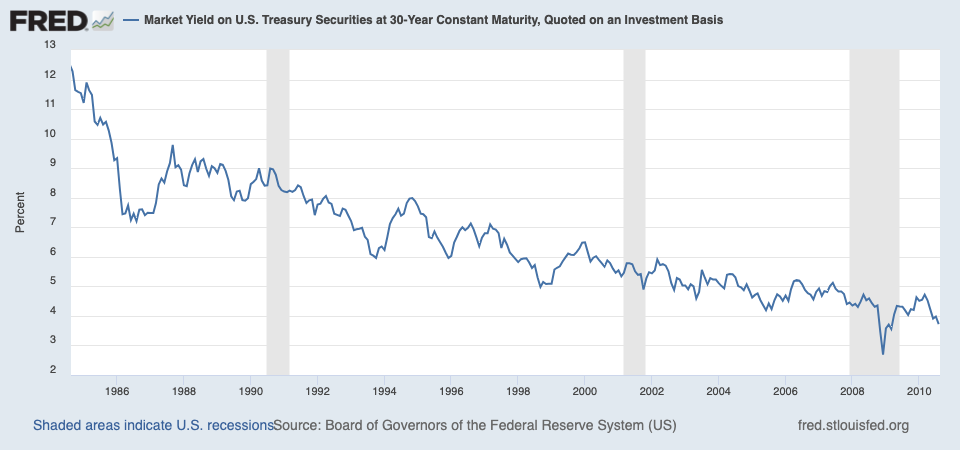

Beneath the surface, a bigger problem loomed. Policies were priced too low because insurers didn't know how to correctly forecast the cost of LTC.

Insurers faced several issues:

- Lack of data to predict future LTC costs

- An unexpectedly high rate of policy renewals

- Falling interest rates affected their investments

These problems resulted in insurers charging customers too little in annual premiums. Over time, this self-inflicted wound would come back to haunt them.

New regulations

Over the next decade, regulations were introduced to improve the industry.

- 1993 - NAIC introduced consumer protections, renewable policies, adding Alzheimer’s coverage, and clarified care criteria.

- 1996 - HIPPA's Section 7702(b) set a new standard for tax-qualified policies.

Premium increases

In the 2000s, insurers became aware of their mistakes and significantly raised annual premium rates on their existing policies to correct their pricing miscalculations.

Customers were stuck between a rock and a hard place. They were offered three bad choices by insurers:

- pay more every year

- agree to less benefits

- cancel their policies

Many insurers stopped selling LTCi (only 10-15 remain), and new regulations followed:

- 2002 - NAIC introduced "Rate Stability" rules to limit premium increases.

- 2005 - The Deficit Reduction Act created long-term care partnership plans.

- 2010s - Technology improved underwriting and pricing models.

Reputational damage

Understandably, the history of underpricing policies and the resulting rate hikes caused huge customer frustration.

The mistakes also caused reputational damage to the LTCi industry. Check out this report from the New York Times and KFF about the problems of many old policies:

Or, if you're a visual learner, check out this 4-minute video from the Wall Street Journal covering the same issues:

Improved long-term care insurance

If you only read the headlines, you wouldn't consider insurance as a good option in your long-term care planning. But you might miss the bigger story.

Long-term care insurance policies have improved. To stick with our Coca-Cola example, the bad-tasting soda is no longer being sold.

If you purchase a new traditional policy, it typically includes:

- new regulations for consumer protection

- better pricing to prevent big price hikes

- improved tax benefits

- partnership plan benefits (keep your assets from MedicAID)

Even better, a new type of policy was created, hybrids, that fixes other issues of traditional plans.

Wrap up

Ask friends and family about their experiences with long-term care insurance, and you'll likely hear one of two stories.

- Good - "My mother had long-term care insurance, and it was a godsend when she moved into an assisted living facility."

- Bad - "I purchased long-term care insurance twenty years ago, and they raised my annual premiums by 100%. I'm so angry."

To put it in perspective, most people won’t use their LTC benefits until 25+ years after purchasing a policy. Since hybrid policies with cash indemnity only became available in the late 2010s, it will be decades before we hear their success stories.

Don’t want to relive the mistakes of the past? Dive into the new world of LTC insurance—no bad-tasting sodas here, just better coverage for you and your family.