Intro

Memory care is a specialized form of long-term care for individuals with Alzheimer’s, dementia, or other cognitive impairments. It focuses on managing memory loss, wandering, and agitation while providing activities to support cognitive function.

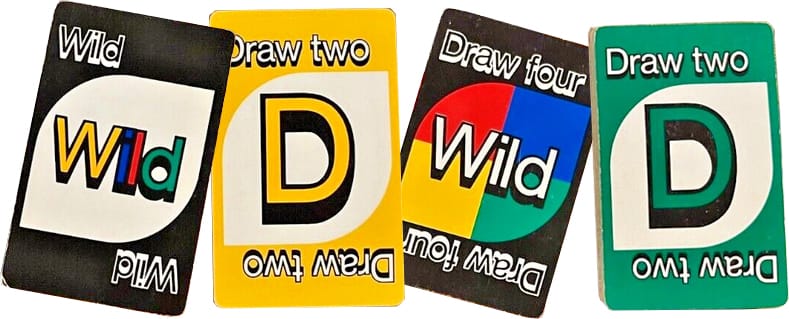

While most long-term care averages around 3 years, memory care is the wild card because it's unpredictable and expensive. Alzheimer’s patients often need 8-10 years of care, with some requiring up to 20 years. To make matters worse, the cost is not covered by Medicare, private health insurance, or MedicAID (except in special circumstances).

That’s why it’s important to focus on your LTC goals: Learn about options, Talk with family, and Create a plan. Planning for memory care can be tough—you don't know if you'll need it or for how long, but you need a plan if you receive this card.

Post jargon

Alzheimer's: the most common type of dementia (memory impairment or loss)

assisted living: a type of residential care that assists with ADLs

caregiver creep: provides direct, hands-on assistance with daily LTC

cognitive impairment: memory or reasoning problems (e.g., Alzheimer’s or dementia)

dementia: a broad term for memory issues, including Alzheimer's

MedicAID: healthcare public assistance

Medicare: health insurance for 65+ adults and disabled

nursing home: like a hospital, but with fewer doctors and for LTC

➡️ Explore all the LTC jargon

Odds

The percentage of seniors with Alzheimer's goes up with age, and women are twice as likely as men to develop the disease.

If you chart the typical duration of long-term care, it’s a bit unusual. The graph slopes downward over time but spikes at the end. 🫤

Why? Alzheimer’s patients need 8-10 years of care on average, with some requiring as much as 20 years.

This unpredictability makes memory care the wild card of long-term care planning. While typical LTC usually last 3 years, if you require memory care, you might need 3 to 6 times more coverage.

Home care

Many people with memory issues prefer staying at home for as long as possible.

Unsurprisingly, most people feel more comfortable receiving memory care at home, and facility-based memory care can be costly.

The real challenge is figuring out who will provide the care—and at what hidden cost. We'll explain below.

Family caregivers

Caring for someone with Alzheimer’s at home requires a lot of family support. Early stages may need just a little help, but as the disease progresses, constant care is often required and results in caregiver creep.

One of the hidden costs of home care is the toll on unpaid family caregivers. Many face high levels of emotional and physical stress and loss of income.

Watch this quick 3-minute video with Maria Shriver about the challenges family caregivers face when caring for a loved one with Alzheimer’s.

Families often think about moving a loved one to memory care when they become a danger to themselves (like wandering or forgetting to turn off the stove), danger to others, or when caregivers hit burnout.

Senior communities

Memory care facilities are the fastest-growing sector of the senior housing market and are often found within assisted living communities or nursing homes.

Memory care is tailored for those who need more than just help with daily tasks. It focuses on cognitive health to boost memory and reduce confusion.

Other support includes:

- 24/7 supervision for safety

- Staff specially trained in dementia care

- Activities to improve cognitive function and ease anxiety

- Help with medication management

- Physical and occupational therapy as needed

- Enhanced security, like alarmed doors and tracking bracelets to prevent wandering

Costs

Memory care typically costs more than assisted living but less than nursing care.

Rates can vary widely by state, so be sure to check local prices.

Payment options

Most memory care is covered by personal savings or long-term care insurance.

- 🔴 Private health insurance doesn't cover memory care.

- 🔴 Medicare doesn't pay for memory care.

- 🟡 MedicAID only helps if you have a severe financial hardship or a disability.

- 🟢 Long-term care insurance covers memory care.

Betting your retirement savings on the hope that you won’t need memory care might not be your best option.

Long-term care insurance

Many people rely on long-term care insurance to manage the financial risks of memory care. Cognitive impairment is one of the criteria for LTCi benefits.

However, most policies only provide coverage for 6 to 8 years. If you're concerned about extended memory care needs, consider these options:

- Join a CCRC that offers an all-inclusive care plan or a lifetime promise (essentially insurance).

- Spend more premium on a hybrid cash indemnity policy. Save unused benefits early to use later for extended memory care.

- Get one of the few LTCi policies that offer lifetime protection:

Online facility research

Start by reviewing inspection reports. If the memory care unit is part of a:

- Assisted living facility - Check your state’s Department of Public Health website

- Nursing home - Use ProPublica’s Nursing Home Inspect tool

Next, check these options.

- Review sites: US News, Caring.com, Yelp, and Google (reviews can be limited, so compare across multiple platforms)

- Directories: Community Resource Finder (look for the "Memory Care Certification" logo) and Senior's Blue Book

- Employer reviews: Glassdoor and Indeed

- Senior placement agencies: Search for local options and check chains like Care Patrol and Caring.com. They offer free guidance and support, but since advisors are compensated by the facilities, it's important to do your own research.

Personal visits

Choosing a memory care facility is a big decision—financially, emotionally, and health-wise—so take your time and shop around. Remember, they want your business. 😄

- Prep: Read reviews, check inspection reports, and explore their website.

- Observe: Ensure cleanliness, security features (like locked exits), and well-maintained spaces.

- Talk: Ask staff about their dementia training and observe resident interactions. Speak with visiting family members to get their insights.

- Evaluate: Inquire about care plans for dementia progression and crisis management.

- Activities: Review memory-focused programs and observe a session if possible.

- Check costs: Get a clear breakdown of all fees, including future care costs.

Wrap up

Memory care is the real wild card in long-term care planning—unpredictable and often costly. Which card are you going to get?

Families face emotional, physical, and financial challenges. Just like in a game of UNO, planning ahead and having the right cards (like long-term care insurance) can help you handle whatever this wild card throws your way.