📺 Watch this post and others on our website and our YouTube channel.

Intro

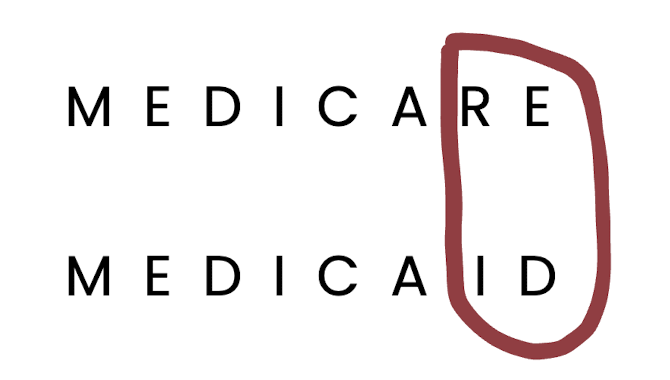

Medicare and MedicAID are often mistaken as twins. Both were born in 1965, but despite their shared origin, they serve very different purposes. Medicare is a form of insurance, while Medicaid provides public assistance.

Now let’s address the elephant in the room: the two words look almost exactly alike. Some genius in the 60s decided to vary their names by only two letters.

Really? This would be like having fraternal twins and naming them Kristina and Kristine, then asking everyone in the country not to mix the two up.

So, going forward, we'll spell Medicaid as "MedicAID" on this website (capitalize the last three letters) to help differentiate between the two words.

Post jargon

ADLs (activities of daily living): basic tasks like bathing, dressing, eating, transferring, toileting, and continence

Alzheimer's: the most common type of dementia (memory impairment or loss)

assisted living: a type of residential care that assists with ADLs

home care: LTC provided at home

hospice: end-of-life care (usually under 6 months)

MedicAID: healthcare public assistance

Medicare: health insurance for 65+ adults and disabled

nursing home: like a hospital, but with fewer doctors and for LTC

spend down: reducing your assets to qualify for MedicAID

waivers: MedicAID programs funding home care and ADLs in senior communities, often waitlisted

➡️ Explore all the LTC jargon

Medicare

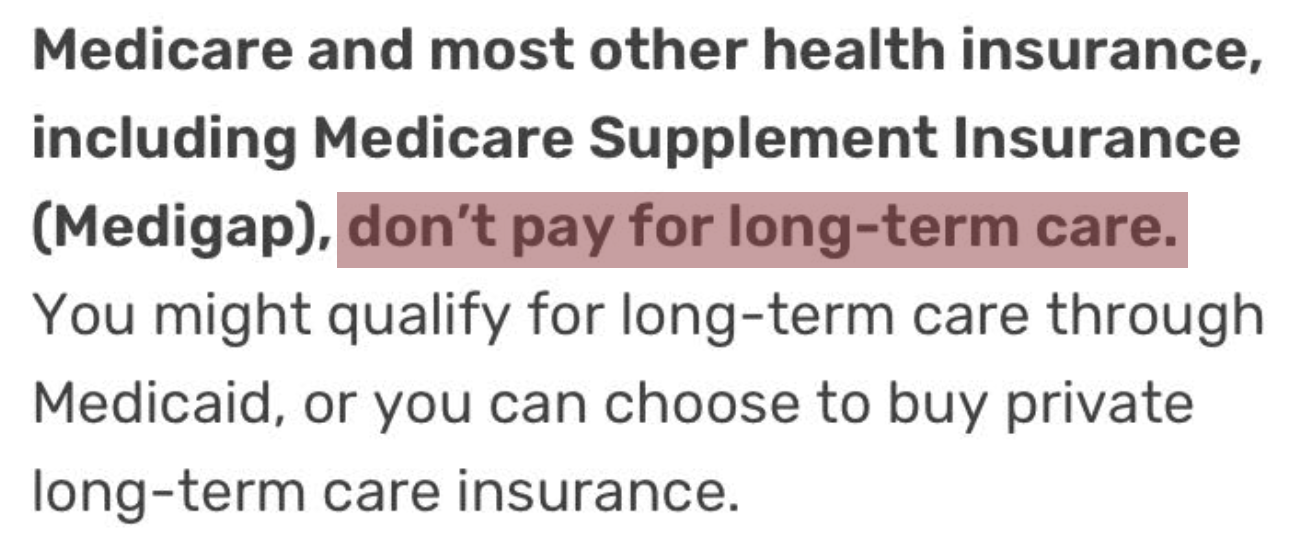

Medicare is an incredible health insurance program for seniors 65+ years old, but it doesn't pay for long-term care.

From the official Medicare website:

Medicare only pays for some short-term care.

| Type | Medicare pays for |

|---|---|

| Home care | None |

| Assisted living | None |

| Nursing home | First 100 days |

| Hospice | Under 6 months |

Since we focus on long-term care, we'll move on to the other twin.

MedicAID

MedicAID, a public assistance program, only pays for long-term care costs if you have severe financial hardship or disability.

We'll repeat this and even add bullet points because it's important.

MedicAID only pays for long-term care costs if you have:

- severe financial hardship, or

- a disability.

If you qualify, MedicAID mainly covers nursing homes unless you receive a waiver for additional care. We'll explain more below.

Severe financial hardship

To qualify, you must have very low income and assets. States will review your financial situation thoroughly, even looking at your assets after you pass away (including loose change under your couch).

- Asset and income limits: You must have less than $2,000 in assets and an annual income of less than $30,000 (in most states). If you exceed these limits, you’ll need to spend down the excess before qualifying.

- Accounts under review: States will review most of your financial accounts, including IRAs and pensions. However, your home is typically excluded, subject to a state-specific value limit.

- Medicaid debt tracking: MedicAID keeps track of what it spends on your care that isn’t covered by your own payments. This running total is called your MedicAID debt.

- Estate recovery: If you’ve received benefits and pass away with MedicAID debt, state agencies may seek repayment from your estate — often targeting your home.

We don't do fear-mongering, but this additional one is crazy. 👇🏼

- Many states have laws that make their children responsible for their parents' unpaid long-term care costs after they die. Fortunately, these laws are rarely enforced.

Hide your money?

If you're already thinking about ways to hide your money, you might be surprised to learn that you're not the first. 😏

- Some set up irrevocable trusts to hide their money, but you have to plan ahead. MedicAID has a five-year lookback period, which means they’ll check your financial history from the past five years to see if you’ve given away money or assets to qualify for benefits. If they find anything that looks like you’re trying to game the system, it could delay your eligibility.

- This lookback period was increased to five years from three in 2006, so the rules can change again.

Government-supported programs

States and the federal government support some programs to help individuals manage long-term care (LTC) costs through MedicAID, even if they exceed eligibility limits:

- LTC partnership policies: State-approved LTCi policies allow policyholders to protect a portion of their assets if their care needs exceed their policy benefits, enabling them to qualify for MedicAID. For every dollar your policy pays for care, MedicAID lets you keep a dollar of your savings. These policies vary by state and are ideal for individuals planning ahead who want to combine private insurance with MedicAID protections. Learn more.

- Qualified Income Trusts (QITs): Also called Miller Trusts, these trusts are available in many states for individuals whose income exceeds MedicAID limits. They enable MedicAID qualification by redirecting excess income into the trust, but remaining funds may be subject to estate recovery after the beneficiary's death. QITs are best suited for those with high income but limited assets. These trusts are complicated and must be established with the help of an elder law attorney to ensure compliance with state-specific rules. Learn more.

Both of these programs can help you qualify for MedicAID-funded long-term care, but your care options will be more limited compared to using private funds or long-term care insurance.

Fireworks

Whoa. That got a little boring. Let’s brighten things up a little.

Limited care options

If you qualify for MedicAID, your long-term care options are often limited and depend on your state's specific rules. MedicAID primarily covers nursing home care, though some states offer waivers that expand coverage.

- 🟡 Home care - May cover ADLs through waivers, but coverage varies, and waiting lists are common.

- 🟡 Adult daycare - May fund services via waivers, with frequent waiting lists.

- 🔴 Continuing care retirement community (CCRC) - Does not cover entry fees or monthly costs, only skilled nursing if the facility accepts it.

- 🔴 Assisted living - Rarely covers room and board, only limited ADLs via waivers, often with long waiting lists.

- 🟡 Memory care - May fund services through waivers, but limits on room and board apply, with waiting lists common.

- 🟡 Nursing home - Accepted in 62% of facilities, but MedicAID reimbursement is below cost in 80% of facilities, potentially affecting quality.

- 🟢 Hospice - Fully covers palliative and end-of-life care without significant restrictions or waiting lists.

If you don’t have funds, MedicAID is an incredible resource for long-term care, but it comes with limited coverage and funding for services.

Wrap up

For your long-term care planning, relying on Medicare or a MedicAID-funded facility at a discounted price might not be your best option. Instead, focus on creating a plan that gives you more control and better care options.

By planning ahead, you give yourself the best chance to receive the quality care you deserve without depending on MedicAID unless it's truly necessary.

Use the same acronym we use for long-term care (LTC) as a reminder to Learn about your options, Talk with your family, and Create a plan that reflects your preferences. Understanding your government-funded options is key.