Intro

In Hamilton, Alexander Hamilton declares, “I am not throwing away my shot!”—a reminder of the power of planning and taking control of the future.

Creating a long-term care plan is your “shot” at ensuring peace of mind for you and your family.

- For those who may need care one day, a plan allows you to make decisions now that keep you in the driver’s seat.

- And for family members, it’s a path to clarity and security, knowing there’s a roadmap in place.

By taking steps today, you’re setting up a future that supports everyone involved—without throwing away your shot at a secure, prepared tomorrow.

Plus, once you create a plan, you won't have to think about it again for a while. 😄

Post jargon

advance directive: document stating your healthcare choices and decision-maker

assisted living: a type of residential care that assists with ADLs

CCRC: continuing care retirement community; housing with many LTC services

home care: LTC provided at home

hybrid policy: newer LTCi combining life insurance with LTC benefits

living will: a document outlining treatments you want or don’t want if unable to speak

MedicAID: healthcare public assistance

nursing home: like a hospital, but with fewer doctors and for LTC

power of attorney: assigns someone to make legal or financial decisions for you

➡️ Explore all the LTC jargon

Why bother to plan?

Picture this: you're 80 and suddenly need help with a sponge bath on a random Tuesday. Who you gonna call?

Your daughter? Your neighbor? 😬

Be proactive and not reactive. A plan puts you in control and spares others the stress.

Plus, it protects your wallet. Care is expensive, and without a plan, you could drain your savings or put that challenge on your family. A good plan helps you afford the care you need, when you need it.

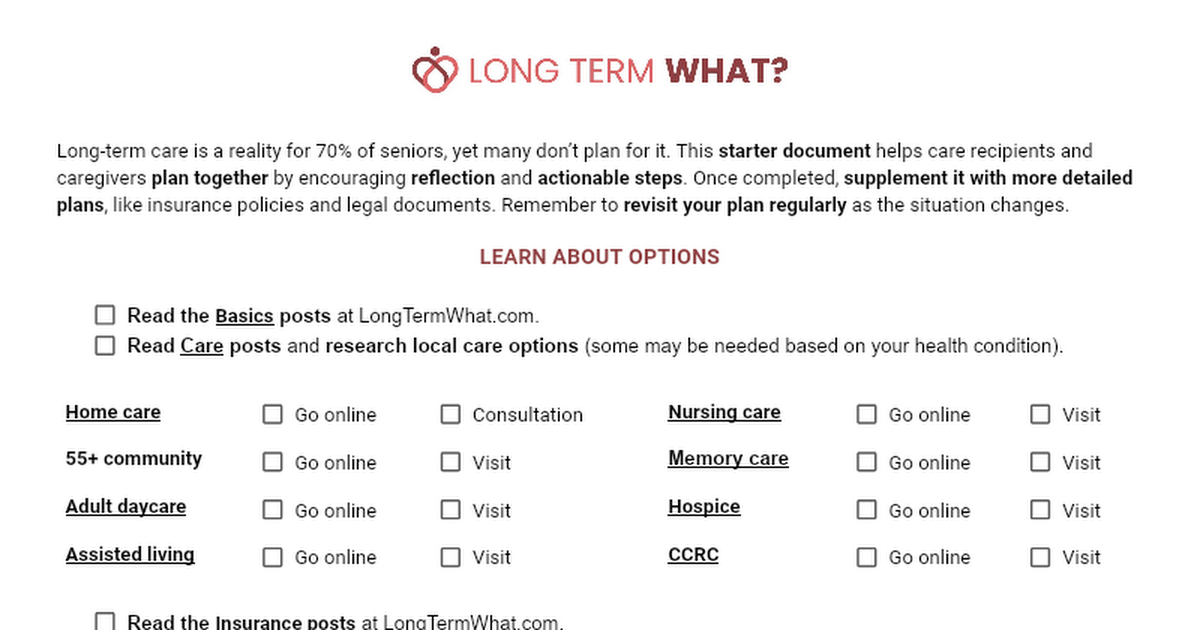

Get the checklist

Download a free, editable checklist. It offers simple steps to help you create an LTC plan that supports both care recipients and caregivers.

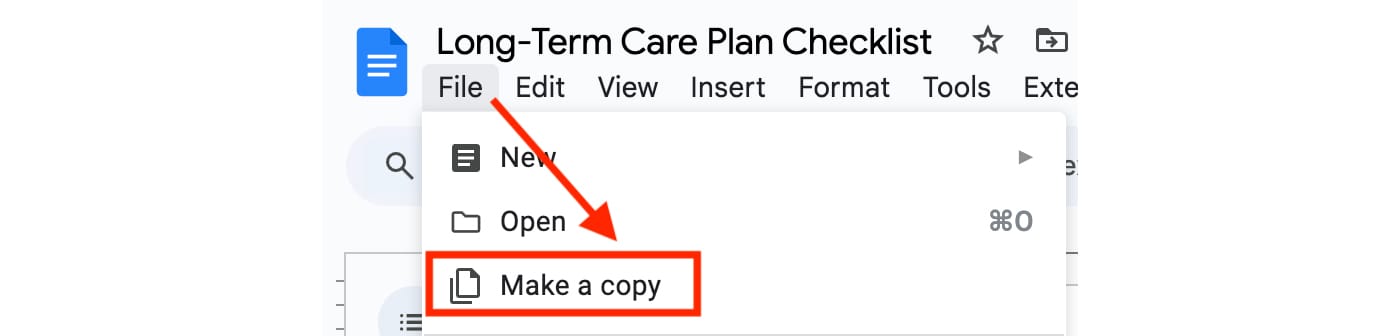

To get your checklist:

- Click the below link/box.

- If you have a Google account, then File > Make a copy. You'll have your own copy to edit as an online Google Doc file.

- If you don't have a Google account, then File > Download. You'll have your own copy to edit as an online Word or PDF file.

- Or File > Print for a paper copy. You'll have your own hardcopy to edit with a good ol' pencil or pen.

Read about options

Start by learning about your options on this website.

- Learn the basics: costs, odds, and options.

- Explore care choices: home care, CCRCs, and more.

- Understand long-term care insurance: hybrids vs. traditional plans.

Once you're armed with knowledge, it’s time to talk to your family.

Talk to family

Here comes the “fun” part. And by fun, we mean essential.

Sitting down with your family to discuss future care can save everyone a lot of awkwardness and stress later.

- You don’t want your family guessing whether you’d prefer home care or assisted living.

- What you want may not be what they want.

The Talk gives everyone peace of mind and a clear plan.

After the first talk, don’t stop there—keep the conversation going. Things can change, and keeping everyone on the same page is key.

Create a plan

Once you've learned about long-term care and talked with your family, it’s time to make real choices.

Don’t leave things up in the air. Don’t "figure it out later." Choose now, write it down, and share your choices with your family.

- Who will care for you? Don’t assume your spouse or kids will step in. If your child volunteers, make sure they understand the challenges, as caregiving can be tough both emotionally and physically.

- Where would you like your care? If you need to move, choose a specific facility. Tour assisted living centers, nursing homes, or CCRCs. Once you’ve seen a few, your choice will be clearer. Consider putting down a refundable deposit—many places have long waiting lists.

- How will you pay for care? Assume you’ll need professional care—otherwise, you’re not covering all the bases. If you plan to self-fund, set up a dedicated care account. If long-term care insurance is an option, get quotes (see below). If neither is affordable, make sure you qualify for MedicAID.

- Are your documents in order? You’ll likely want advance directives, like a living will and power of attorney. Think of these as adult treasure maps, guiding your loved ones when they need it most.

Wrap up

Creating a long-term care plan is your chance to be like Hamilton—taking your shot to secure a well-prepared future.

By learning about care options, talking openly with family, and making decisions now, you’re building a foundation that will benefit you and your loved ones for years to come. Don’t wait; take charge and set the course for a future on your terms.