Intro

In a previous post, we covered the basics of hybrids—how they blend life and long-term care insurance.

In this post, we’ll pop the hood and explain the most confusing details in plain English. It's a little nerdy and deserves a separate post.

That said, when you’re buying a car, you probably don’t study how the V6 engine works. Similarly, you don’t need to know all the mechanics to buy a hybrid policy. If numbers aren’t your thing, cruise on over to the next post.

Post jargon

benefit: the amount LTCi pays for covered care expenses

benefit period: the maximum time LTCi pays for care after criteria are met

CD: certificate of deposit; a safe investment

death benefit: a payout to a beneficiary from a hybrid policy after the insured passes away

extension of benefits: an LTCi bucket of money used after the initial benefit period; same as continuation of benefits (COB)

inflation protection: LTCi benefit that adjusts for rising costs

LTC: long-term care

LTCi: long-term care insurance

opportunity cost: what you lose by choosing one option instead of another

premium: the payment to maintain insurance

specified amount: initial pool of money allocated for LTC or death benefits (same as face amount)

➡️ Explore all the LTC jargon

How it works

Here’s a breakdown of the key parts that make hybrids tick—terms you’ll often see in your insurance quotes.

In the example below, imagine you make a one-time $100k premium payment at age 50 for a hybrid with a 6-year benefit period which starts when you need LTC. The numbers vary based on your age, health, and specific policy, but let's roll with this scenario.

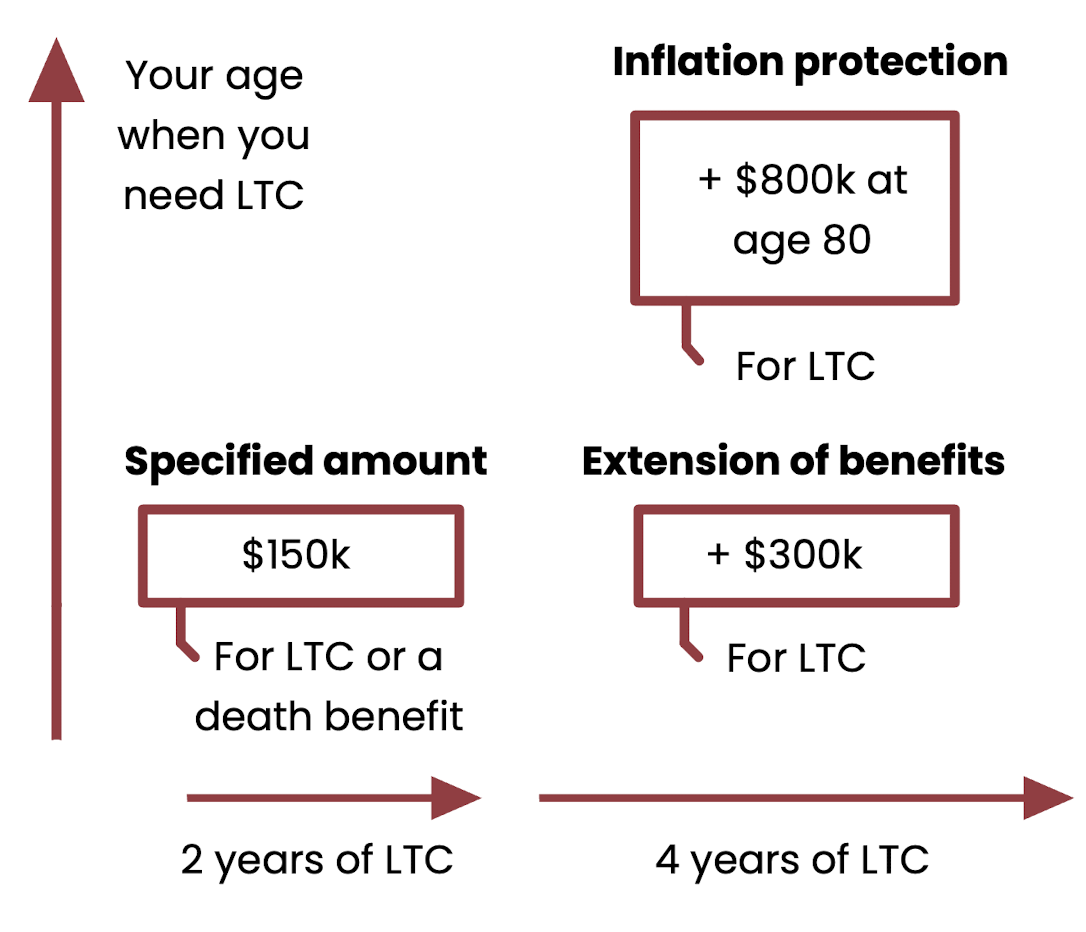

You'll typically have 3 pots of money in your hybrid policy, as shown in the red boxes, to receive benefits.

- Specified Amount: This is your initial pool of money, offering $150k over two years if you need LTC. If not, it becomes a death benefit for your family. This may also be called your face amount.

- Extension of benefits (EOB): Think of this as a safety net that kicks in when your specified amount runs out, providing an extra $300k over four more years. This may also be called your Continuation of Benefits (COB).

- Inflation protection: This feature increases your benefits over time to keep up with rising costs. For example, by age 80, your coverage would add an extra $800k, bringing your total to $1.25 million over six years if you need LTC.

Below is a very rough example of how these pots of money are used if you need LTC on the first day you own the policy (age 50). For simplicity, we'll ignore inflation protection in the table below.

| Years of LTC | You get | Specified amount balance | Extension of benefits balance |

|---|---|---|---|

| 0 | $0k | $150k | $300k |

| 1 | $75k | $75k | $300k |

| 2 | $75k | $0 | $300k |

| 3 | $75k | $0 | $225k |

| 4 | $75k | $0 | $150k |

| 5 | $75k | $0 | $75k |

| 6 | $75k | $0 | $0 |

- In years 1-2, your benefits come from your specified amount.

- In years 4-6, your benefits come from your extension of benefits.

Once you’ve got these parts down, hybrids will make a lot more sense as you decide between various LTCi choices.

The cost

When you purchase hybrid long-term care insurance, the premiums you paid go to your family as a death benefit if you don’t use the policy benefits.

Wait. So your insurance is... free!

Kind of, but it's a little more complicated.

When you spend $20 on a sweater, your cost is $20 (duh).

However, buying a hybrid costs a lot more than $20, so you might consider the cost of not investing your money elsewhere (your "opportunity cost").

For example, let's say you have $100k and have two choices:

- invest the money and earn interest

- buy a hybrid

Let's compare these two choices if you never need long-term care.

| Years alive | Invest it at 3% | Buy a hybrid (no LTC needs) | "Cost" of a hybrid |

|---|---|---|---|

| 0 | $100k | $150k | - |

| 5 | $116k | $150k | - |

| 10 | $134k | $150k | - |

| 15 | $155k | $150k | $5k |

| 20 | $180k | $150k | $30k |

| 25 | $209k | $150k | $59k |

| 30 | $242k | $150k | $92k |

Let's review the bolded row if you died in 25 years.

- Invest it at 3%: With this option, your family would receive about $209k after 25 years.

- Buy a hybrid (no LTC needs): Your family would receive $150k if you don’t end up needing long-term care.

- "Cost" of a hybrid: The “cost” of choosing the hybrid is $59k, reflecting the amount you’d forgo by choosing the hybrid.

If you ended up needing LTC, insurance would almost always be the better choice. But if you didn’t need LTC, owning coverage could mean an opportunity cost of $59k in 25 years.

So, here’s the question to consider: is the opportunity for security, benefits, and peace of mind from LTC insurance worth the trade-off of potentially higher returns from other investments?

Questions

Now that we’ve walked through the basic costs of hybrids, let’s address some questions that might come up when considering these policies.

Q: I made a one-time $100k payment but I get a $150k death benefit?

A: Yep. You’ll get back what you paid plus a bit extra. The exact amount varies, but $150k on a $100k premium is a good estimate for many policies.

Q: Do I have to pay $100k all at once?

A: Nope. Hybrid policies offer flexibility. You can pick an upfront payment or spread out payments (e.g., annually over 10 years) to match your budget.

Q: What happens to my $100k after I pay it?

A: Insurers typically invest it in safe bonds to grow the funds.

Q: In this example, couldn't I earn more than 3%?

A: Maybe. But tax benefits on LTC insurance mean a 3% tax-free return might equal a 5% taxable one. You could earn more in other investments, but higher returns often come with greater risk. Check out this post:

You're on your way to becoming a hybrid expert. Keep going.

Q: What happens to my death benefit if I need long-term care?

A: The death benefit is used to cover your care costs first. For example, if your policy specifies a $150k death benefit and you use $100k for long-term care, your family would receive around $50k as a death benefit.

Q: So the first $150k of benefits effectively comes out of my pocket?

A: Yes. Think of hybrids as high-deductible plans: you effectively self-fund the first portion ($150k in our example) before accessing your extension of benefits.

Wrap-up

When you buy auto or home insurance, you’re not thinking about other investments — you're just buying insurance.

People see hybrids the same way. They're insurance:

- If you need care, you're glad you have it. You win big time.

- If you don’t, your family gets the death benefit as a bonus.