Intro

When it comes to long-term care insurance (LTCi), you get to choose between two contenders in a race for your long-term care needs: traditional policies and hybrids.

The first hybrid LTCi policy, OneAmerica Asset Care, was introduced in 1989 to tackle challenges associated with traditional policies. Since then, newer policies have emerged, continually enhancing LTCi benefits.

Remember those Saturday morning cartoons where the Road Runner speeds through a canyon, and the Coyote tries to follow, only to end up crushed by a falling boulder he accidentally triggered?

Let’s compare hybrids to the Road Runner, who always manages to stay one step ahead of his rival, Wile E. Coyote. No matter what trap is set, the Road Runner zips through obstacles with speed and ease.

Like the Road Runner, hybrid policies use creative solutions, such as combining life and long-term care insurance, and offer flexible maneuvers, like cash indemnity benefits (which we'll explain in a minute).

For a fun trip down memory lane, check out this 30-second clip.

Remember to use the letters LTC as a guide to achieve these goals: Learn about options, Talk with family, and Create a plan. Choosing between traditional and hybrid LTCi is an important step in reaching these goals.

In this post, we’ll explore how hybrids compare to traditional LTCi and what to look for in a hybrid policy.

Post jargon

benefit: the amount LTCi pays for covered care expenses

cash indemnity: pays the full benefit, regardless of the actual care costs

death benefit: a payout to a beneficiary from a hybrid policy after the insured passes away

hybrid policy: newer LTCi combining life insurance with LTC benefits

LTC: long-term care

LTCi: long-term care insurance

partnership policy: a special LTCi policy to keep assets from MedicAID

premium: the payment to maintain insurance

reimbursement: covers actual care costs up to a specified limit

traditional policy: early LTC insurance referred to as "pure" LTCi

underwriting: insurer’s review process to decide coverage and cost

➡️ Explore all the LTC jargon

What is it?

Hybrid policies combine two types of coverage:

- Life insurance: Pays the family when the insured passes away.

- LTC insurance: Pays the insured when they need long-term care.

These policies go beyond just providing insurance—they act like a built-in piggy bank, offering funds that belong to you and can be accessed over time.

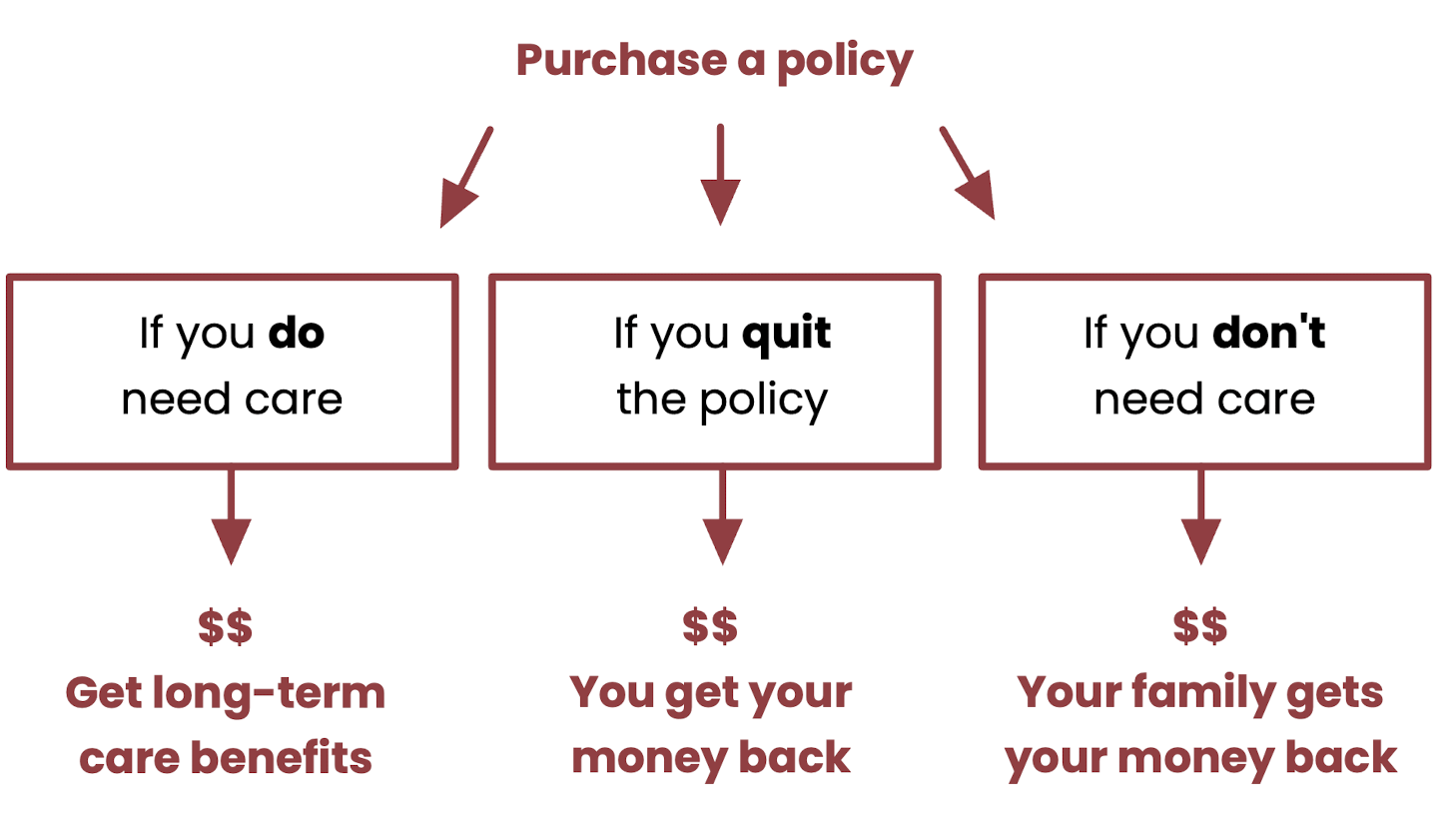

Because of this unique design, hybrid policies provide benefits in three key scenarios.

If visuals are your thing, here’s a simple breakdown.

A closer look at each scenario:

- If you do need care: While the policyholder is alive, they can use the policy to cover long-term care expenses.

- If you quit the policy: The policyholder can cancel and get back some or all of their money, depending on specific terms.

- If you don’t need care: When the policyholder passes away, their family (the beneficiary) typically receives a payout.

Let’s explore these scenarios further and see how hybrid policies improve upon traditional insurance.

Benefits

Hybrids solve several problems of the old traditional plans. The below comparisons apply to most policies.

| Traditional | Hybrid |

|---|---|

| Use it or lose your premium | ✅ Get a premium refund |

| Show receipts, get reimbursed | ✅ Get cash (indemnity) |

| Pay annual premiums forever | ✅ Option to pay once |

| Premiums can go up | ✅ Premiums cannot go up |

| Strict underwriting | ✅ Less strict underwriting |

What exactly are these benefits, explained in plain English?

Premium refund

With traditional plans, if you don’t use your benefits, the money spent on premiums is typically lost (you don't get it back).

To be fair, most other types of insurance (like auto and home) work the same way—but we get it.

Comment

by u/Sure_Raspberry from discussion

in financialindependence

Hybrids, on the other hand, are different. If you don’t use your benefits, the premiums you paid are given to your spouse or kids as a "death benefit," which can help provide a bit of financial stability during a difficult time.

Wait. So your insurance is... free!

Well, sort of, but it’s a bit more nuanced.

Yes, your family can get your premiums back when it's needed most, but you lose the chance to earn interest if you had invested it elsewhere.

Still, not bad.

If you want to nerd out on the details of how hybrids work, check out this post.

Cash indemnity

New hybrid long-term care policies offer a benefit called "cash indemnity."

Here's how it works. When you need LTC, you don't have to submit receipts like traditional LTCi. Instead, you just get your maximum benefit in cash regardless of actual costs. Less work and more money.

This is a big benefit. Explore more in this post.

Premiums cannot go up

One of the biggest complaints about traditional LTCi policies is the risk of rising premiums over time—there’s no telling how much you’ll end up paying.

With hybrids, your premiums are locked in. Whether you choose to pay in a lump sum or spread it out over several years, hybrids provide peace of mind as you plan.

Payment options

Hybrid long-term care policies offer flexible payment options to fit different budgets:

- Single-pay: One upfront payment, offering the lowest total cost.

- Multi-pay: Spread payments annually over 5 or 10 years or longer.

For multi-pay options, payments usually stop once you start receiving LTC benefits, thanks to a feature called "waiver of premium."

The costs

Costs and benefits for LTCi depend on the insurer, your health, and other factors (see our pricing calculator). With that in mind, here’s a side-by-side comparison for a healthy 55-year-old non-smoker in Colorado with a 6-year policy and 3% compound inflation protection:

| Traditional LTCi | Hybrid LTCi | |

|---|---|---|

| One-time premium | $3,600/yr for life | $5,500/yr to age 100 |

| Benefits at age 85 | $1,040,000 | $1,040,000 |

| Death benefit | $0 | $130,000 |

In this example, the traditional policy is less expensive for similar benefits at age 85, while the hybrid provides money to your family if the benefits aren’t used.

Hybrid examples

Check out hybrid reviews from Long Term What? with star ratings.

The downside of hybrids

Although hybrids fix multiple problems in traditional plans, they're not perfect for everyone. Traditional policies are better in a few ways.

| Traditional | Hybrid |

|---|---|

| ✅ Lower cost | Higher cost |

| ✅ Partnership policies | No partnership policies |

| ✅ Tax benefits | Fewer tax benefits |

It's hard to compare traditional and hybrid options, so we suggest getting quotes for both when shopping for insurance.

Wrap-up

Hybrids, much like the Road Runner, use smart and flexible solutions.

- Hybrids dodge the pitfalls of “use it or lose it” by including death benefits.

- They pay more with cash indemnity.

- They offer greater flexibility for care needs.

While no insurance solution is perfect, hybrids strike a good balance between financial security and flexibility. Just like the Road Runner zipping through obstacles, hybrids can help you confidently navigate long-term care planning.