Intro

Choosing the amount of insurance coverage to buy is a little like packing for a surprise trip.

If you knew exactly how much long-term care you needed, you'd know exactly how much insurance to get. But without owning the iPhone 32 with the time travel app, iZap, you just don't know.

For a surprise trip, what if you looked in your partner's suitcase to see what they packed? You still wouldn't know where you were going, but you could make an educated guess about what to bring.

When choosing insurance coverage, what if you looked at what other people have needed for their long-term care? You still wouldn't know your future, but you could make an educated guess of how much coverage to buy.

In this post, get the tools to choose your coverage amount. Your choice won't be perfect, but at least you won't pack a bathing suit for Alaska. 😄

Post jargon

Alzheimer's: the most common type of dementia (memory impairment or loss)

assisted living: a type of residential care that assists with ADLs

CCRC: continuing care retirement community; housing with many LTC services

day 1 benefit: total LTCi benefits accessible when a policy starts

inflation: the rise in the cost of goods and services

LTC: long-term care

LTCi: long-term care insurance

memory care: specialized care for those with memory loss

nursing home: like a hospital, but with fewer doctors and for LTC

senior community: housing providing long-term care for older adults, often with shared activities

➡️ Explore all the LTC jargon

Budget versus need

In the rest of this post, you’ll see an easy way to estimate how much LTCi you might need. But don’t let perfect be the enemy of good.

If your budget only allows for half of what you think you need, that’s still a big step forward. Some coverage is always better than none, and personal funds can fill in any gaps later.

Many plans also let you spread payments out over time, making coverage even more accessible.

So aim for your benefit target, but remember: partial coverage is still a win. 👍🏼

Averages

As a next step, review these two blog posts about averages and keep them handy (e.g., in different browser tabs). You'll use them as a reference later in this post.

Self-assessment

To decide how much long-term care insurance to buy, think about your future self in your 80s. Use your current habits to guide your decision:

- What state will you live in? Do you move often? Where are your kids? Are you happy where you are now? Care costs vary widely by state.

- What kind of care would you prefer? Do you enjoy staying at home or being more social? The cost of care varies for home care or a senior community.

- What level of care would you prefer? Does your lifestyle include comforts like a nice home, frequent travel, or a cleaning service? If so, you may want to budget for more than the average cost of care.

- What is your health history? Does your family tend to live long or pass quickly? Do you have risks like Alzheimer’s? A longer life increases the chance of needing care.

- What’s your risk tolerance? Do you prefer high-deductible (low cost, more risk) or gold plans (higher cost, less risk) for home or auto insurance? Will you rely on savings or need broader coverage? To play it safe, more coverage may suit you better.

Benefit amounts

Once you've reviewed the stats and completed a self-assessment, estimate your benefit amount.

- Step 1: Determine the day 1 benefit you want.

- Step 2: Determine the future benefit you want.

Step 1 - "Day 1" benefit

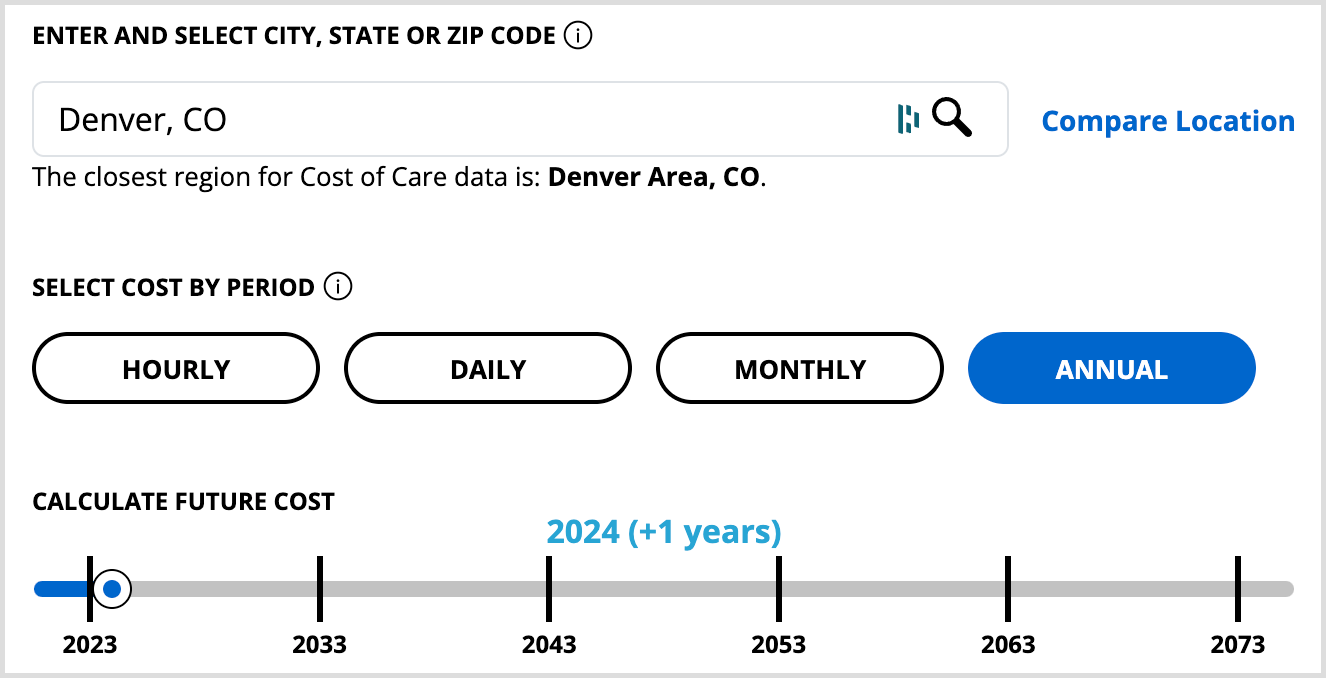

Open this calculator and set some general values:

- state/city

- Select cost by period = Annual

- Calculate future cost = this year

Tips:

- Most people are awake about 112 hrs/week, so 44 hrs/week is roughly 40% of waking hours. To budget for more hrs/week, update the "Weekly In-home care hours" at the bottom of the calculator.

- Go here to find local memory care costs.

Duration by care type

Next, choose how many years of each care type you want to insure.

This may start as a personal preference, but you may need multiple types of care (e.g., 60% of residents transition from assisted living to nursing care).

Now, using your stats, self-assessment, and costs, make an educated guess of the coverage you'd need on day 1.

Example

Suppose you prefer home care but also want coverage for assisted living and nursing care. You don't have a family history of Alzheimer's and want to minimize your premiums, so you don't want to budget for memory care.

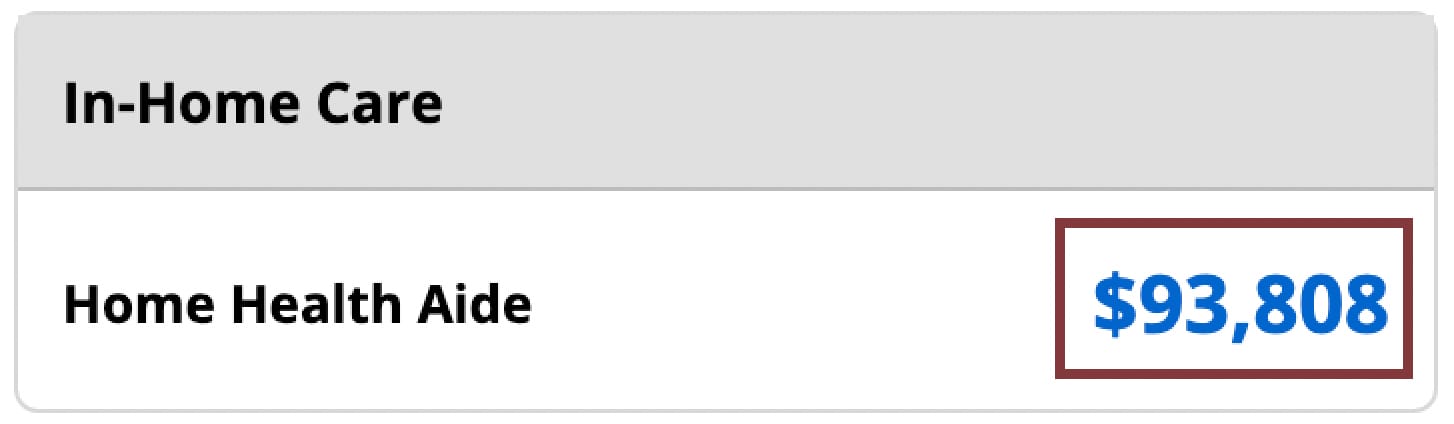

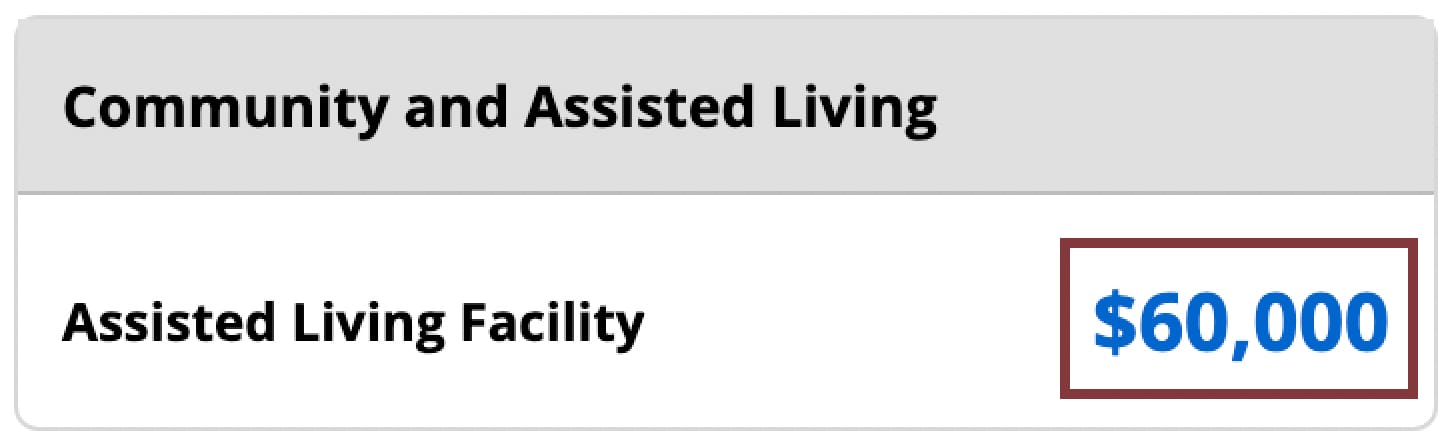

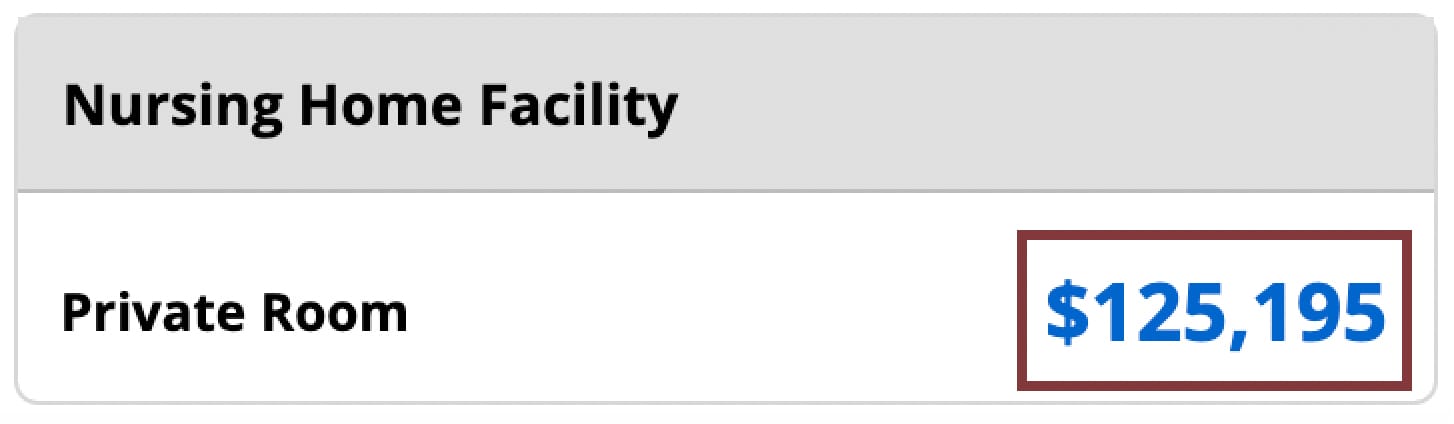

From your calculator, get local annual costs for this year.

Based on care type averages, you might choose:

$282k = Home care ($94k/year) x 3 years (~average)

$120k = Assisted living ($60k/year) x 2 years (~average)

$125k = Nursing home ($125k/year) x 1 year (below average)

---------

$527k = Day 1 benefit target

Once you receive an insurance quote(s), compare your policy's day 1 benefit quote to the day 1 benefit target you calculated.

- In the above benefit quote example, if you need LTC on the first day of your policy, you'd be eligible for $607k benefits over your benefit period (e.g., 6 years). If you need LTC at age 80, you'd be eligible for $1.5m in benefits.

- If your benefit quote is higher than your benefit target, then you can afford the amount of coverage you want.

- If your benefit quote is lower than your benefit target, remember that some coverage is much better than no coverage.

- When you increase or decrease your premium by a certain percentage, your benefit quote will change by roughly the same percentage.

Step 2 - "Future" benefit

Now that you have day 1 benefit, you'll need "inflation protection" to get your future benefits (future dollars).

Many policies offer 1% to 5% inflation protection. With 3% compound inflation, your coverage grows 3% annually. If inflation hits 4%, you’ll have to cover the gap. You can use past LTC inflation rates to help choose a rate.

Quotes

Once you have benefit and inflation protection goals, you can request multiple insurance quotes from us.

Wrap up

Choosing the right amount of long-term care insurance is like packing for that mystery trip—it’s more art than science. Even with data, there’s no perfect answer.

Use this post as a guide, but focus on what fits your risk tolerance and how LTCi aligns with your financial goals. Think of your benefit target as a helpful packing list: it’s okay if you can’t include everything. Some coverage is better than none, giving you some peace of mind for the journey ahead.

Zooming out, remember to use the letters LTC as a guide to achieve these goals: Learn about options, Talk with family, and Create a plan. Choosing your coverage amount will help you create your plan.