Intro

Most people like their home, especially Dorothy in The Wizard of Oz. You're probably familiar with this famous 20-second movie clip.

When Dorothy got older and needed help with dressing and bathing, where do you think she wanted her care?

Senior communities, like assisted living communities and continuing care retirement communities (CCRCs), may offer more social interaction and services, but there’s no place like home for many people.

Your decision about where you'd like to receive care — and who will provide it — plays a significant role in your LTC goals: Learn about options, Talk with family, and Create a plan.

In this post, we’ll guide you through home care options to help you make an informed decision for a long-term care plan that fits both your needs and those of your loved ones.

Post jargon

ADLs (activities of daily living): basic tasks like bathing, dressing, eating, transferring, toileting, and continence

caregiver: provides direct, hands-on assistance with daily LTC

caregiver creep: the gradual increase in care (e.g., shifting from errands to bathing)

care manager: coordinates and oversees care services without direct caregiving

LTC: long-term care

LTCi: long-term care insurance

MedicAID: healthcare public assistance

Medicare: health insurance for 65+ adults and disabled

senior community: housing providing long-term care for older adults, often with shared activities

➡️ Explore all the LTC jargon

Some stats

People have always loved their homes, even when the world was in black and white.

So when they age, it's no surprise that 79% of care recipients want long-term care in their homes.

If you or your loved ones want to receive LTC at home, the key challenge is deciding who will provide it.

- You can rely on unpaid help from family or friends, but the physical, emotional, and financial toll on unpaid caregivers is significant.

- You can also hire help through caregiving agencies, but the costs are often high.

It's a hard choice.

If you choose home care, here's what you'll need to know.

Care roles

Caregivers perform many roles, like transferring (moving someone from a bed to a chair), bathing, and household chores.

So, who can perform these home care roles? Either unpaid or paid caregivers.

Unpaid home care

A whopping 80% of care at home is provided by unpaid family members.

Check out this 20-second clip of Bradley Cooper about caregiving for his dad.

Adult children are often the go-to choice for caregiving.

Caregiver creep

While family members often start with good intentions, many experience 'caregiver creep.' It might begin with helping parents manage finances or providing rides to appointments, but it gradually evolves into assisting with daily tasks like dressing and bathing.

Care needs

To see what LTC is really like, check out this 3-minute training video from a caregiving training series.

As time goes on, care needs may become more complex, such as wound care or using medical devices, along with necessary home modifications like installing safety bars in the bathroom or raised toilet seats.

This caregiver creep occurs with such frequency that adults who care for their children and aging parents at the same time are now labeled the 'sandwich generation'.

This caregiver creep creates a problem.

When caregivers were asked, "Do you feel you had a choice in taking on this responsibility for caring for your mother/father?" the majority said no.

This creep and new role isn't anyone's fault, but it can sneak up on one if they don't learn about it or plan ahead.

As this role grows, it can come with significant personal and financial costs for caregivers.

Personal costs

When family members take on caregiving roles, they often underestimate the hidden health impacts and emotional strain of caregiving responsibilities.

In this caregiver post, click "Read more" for a first-hand comparison of child care to elder care.

Childcare and Eldercare are not the same at all

by in CaregiverSupport

If you're serious about using unpaid family care, spend a few minutes on the "CaregiverSupport" subreddit to learn more about the pros and cons of this option.

Financial costs

This role also affects a caregiver's finances and career.

In short, caregiving isn't good for your personal career ambitions.

So, although the price of home car might be free to you, your family member pays the emotional and financial cost of caregiving.

Respite care

The stress of caregiving has even led to the development of support services known as respite care (pronounced "res-pit").

This short-term care option for older adults, often offered at assisted living facilities or adult day care centers, gives caregivers a chance to take a "staycation" — a restorative break close to home. It allows them time to rest, tend to their own needs, and prevent burnout.

Paid home care

Instead of relying on unpaid, informal help, you can opt for paid, professional home care.

Loved ones can still act as care managers, guiding the process without handling the daily physical tasks, which are managed by a care agency or professional caregiver.

Costs

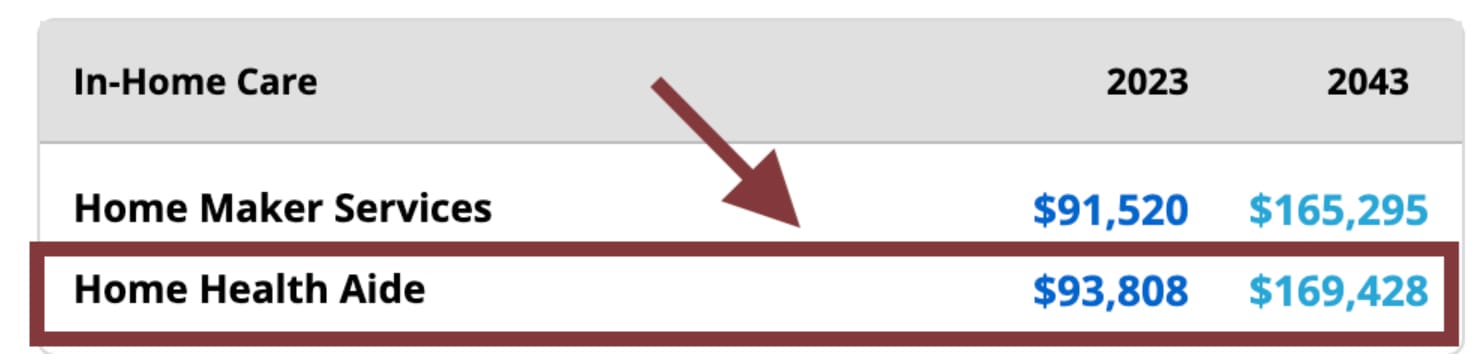

Professional home care comes with a hefty price tag, averaging $78,000 per year. To put that into perspective, the median U.S. household income is $80,000 annually—nearly the same amount.

Costs have surged since COVID, but over the past 20 years, they’ve risen by an average of just 3% per year.

Check out this cost calculator to get a sense of local costs. For example, the median cost in Denver, Colorado, in 20 years is forecast to be $169k/year for 44 hours/week of care.

Find paid home care

When looking for a home care agency, start with recommendations from trusted sources or online reviews. Below are a few good online leads.

Once you find a few you like, learn more.

- Verify licensing, background checks, and reputation.

- Look for flexible care plans, transparent pricing, and good caregiver matching.

- And even better, ensure the staff receive support and training.

Payment options

Unfortunately, Uncle Sam typically doesn't pay for long-term care in the home.

- 🔴 Private health insurance doesn't cover home care.

- 🔴 Medicare doesn't pay for home care.

- 🟡 MedicAID only helps if you have a severe financial hardship or a disability.

- 🟢 Long-term care insurance covers home care (in most modern policies).

Wrap up

Both unpaid and paid home care come with challenges. Unpaid care comes with physical and emotional costs by family members, while paid care can strain finances. Finding the right mix is key.

Like Dorothy, many people want the comfort of home, so they use a few strategies besides clicking their heels to make home care work:

- Combine unpaid care from family with professional support.

- Explore adult daycare services for a few days each week.

- Consider long-term care insurance—especially a hybrid policy with cash indemnity benefits for the most flexibility in using home care.

After reviewing your options, talk with your family and make a plan that covers where you want your care and who will provide it.