Intro

Insurance really proves its worth when you need to claim your benefits—but how many hoops will you have to jump through?

- Fortunately, the government has standardized the criteria for long-term care (LTC) benefits.

- Policyholders are satisfied with receiving their benefits.

- Most hybrid policies allow you to use your benefits for any type of care, like unpaid care from family, without the hassle of submitting receipts.

Filing a claim often comes at a stressful time, so understanding the process now can help you avoid costly mistakes and make life easier.

Post jargon

ADLs (activities of daily living): basic tasks like bathing, dressing, eating, transferring, toileting, and continence

Alzheimer's: the most common type of dementia (memory impairment or loss)

cash indemnity: pays the full benefit, regardless of the actual care costs

cognitive impairment: memory or reasoning problems (e.g., Alzheimer’s or dementia)

dementia: a broad term for memory issues, including Alzheimer's

HIPPA: that privacy law you hear about at your doctor’s office

LTC: long-term care

LTCi: long-term care insurance

reimbursement: covers actual care costs up to a specified limit

➡️ Explore all the LTC jargon

Criteria

When HIPAA was signed in 1996, the government set the criteria for qualifying to receive long-term care.

- Cognitive impairment (think Alzheimer's or dementia) OR

- Needing substantial help with two activities of daily living (ADLs)

To learn more about these criteria, see this post:

Elimination periods

In addition to the criteria above, you must reach the end of your elimination period, the waiting time before your insurance kicks in.

For example, if you have a 90-day elimination period, your benefits don't start until after you need 90 days of care.

Why is it called an elimination period? There's no good reason. It sounds like something an '80s action hero would say.

A better name could’ve been "waiting period" or "benefit delay," but here we are. Think of it like your insurance deductible—only with days instead of dollars.

Check your policy for how your elimination period works.

- Some start after a physician's review while others after care begins.

- Some are cumulative, while others require consecutive days.

- Most policies only require that you meet the elimination period once. If you no longer need care for a few years and then start again, the requirement is usually waived.

Cash indemnity

If your policy uses cash indemnity payments instead of reimbursement, it simplifies the process. You’ll receive the full benefit amount each month with no need to submit receipts, fewer exclusions, and greater flexibility.

Who decides?

Usually, your doctor determines if you meet the criteria (like ADLs or care duration).

After that, you’ll contact your insurer, and a claims coordinator will gather information from both you and your doctor.

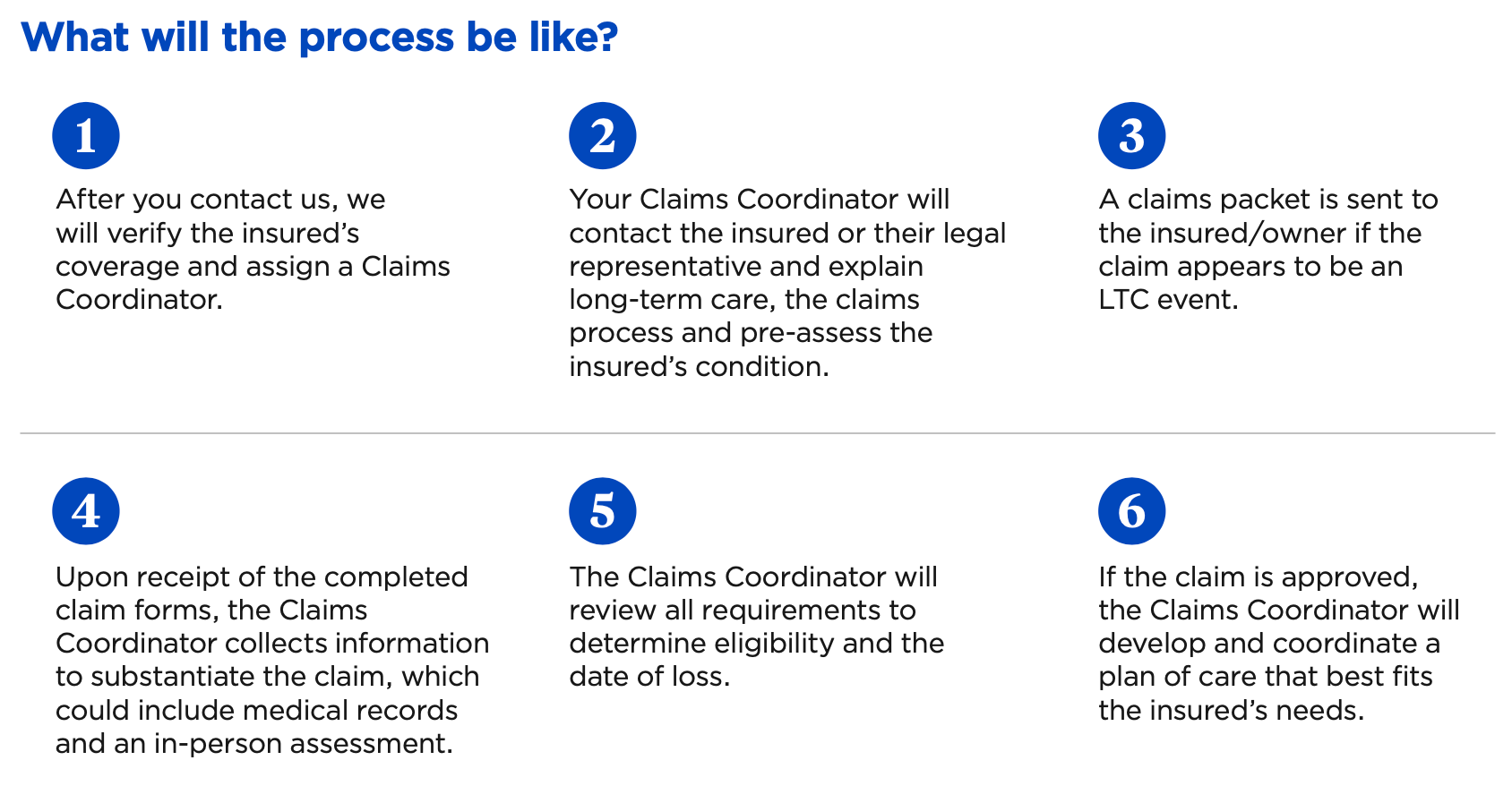

When you file a claim, the process is generally straightforward. For example, below are instructions from Nationwide from their claims website.

You can also check out the Lincoln Financial claims page for their specific processes.

Once approved, your insurer will recertify you every 90-365 days to ensure you still qualify for care and benefits. Roughly 25% recover.

Are insurers fair?

Customer satisfaction is a good gauge of how fair insurers are when it comes to filing claims.

Thankfully, the results of this large study from AHIP are reassuring:

Wrap up

When you qualify for long-term care insurance, you should expect to receive your benefits without much hassle. To make things smoother:

- Opt for a policy with cash indemnity to streamline the process.

- Already have a policy? Call your insurance company with any questions—they’re there to help.

Remember to use the letters LTC as a guide to achieve these goals: Learn about options, Talk with family, and Create a plan. Once you have your LTCi policy, share a copy with your family so they're prepared if a claim is needed.