Intro

When Earth needed a team to defend against extraordinary threats, the Avengers were formed, bringing together Iron Man, Captain America, Thor, Hulk, Black Widow, Hawkeye, and Vision. Their diverse powers 💥 and personalities 🥸 united to create a team stronger than the sum of its parts. 💪🏼

Similarly, Continuing Care Retirement Communities (CCRCs) are like the Avengers of senior living. They combine the diverse powers of independent living, assisted living, nursing care, memory care, and hospice under one roof. Residents benefit from a continuum of care as they age without needing a new superhero every time their needs change.

Remember to use the letters LTC as a guide to achieve these goals: Learn about options, Talk with family, and Create a plan. The choice to join a CCRC can address many challenges at once.

Post jargon

assisted living: a type of residential care that assists with ADLs

hospice: end-of-life care (usually under 6 months)

independent living: age-restricted housing with shared activities, no LTC included

LTC: long-term care

LTCI: long-term care insurance

memory care: specialized care for those with memory loss

nursing home: like a hospital, but with fewer doctors and for LTC

➡️ Explore all the LTC jargon

Overview

The biggest perk of CCRCs is that they're one-stop shops for all your senior needs, including assisted living, nursing care, memory care, and hospice. This means that when you need more care, you don't have to move.

Moving is considered one of life's most stressful events. Moving in your 80s is even worse. Especially if you have to move more than once.

Sure, you might need to move down the hallway to a different wing, but the staff will be there to assist you.

Over 2,000 for-profit and nonprofit CCRCs are in the US. The top 5 largest providers by total units (e.g., apartments) have communities in almost every state.

| Provider | Total units | Locations | Learn more |

|---|---|---|---|

| Brookdale | 56k | 679 | YouTube |

| Atria | 49k | 383 | YouTube |

| LCS | 32k | 135 | YouTube |

| Five Star | 24k | 249 | YouTube |

| Erickson | 23k | 20 | YouTube |

Most of these big providers have huge YouTube channels.

For example, Brookdale's YouTube channel features a "Make It Mine" series where senior living residents get an apartment makeover. Here's a 1-minute preview.

Erickson's channel includes a similar giant library of videos with personal stories. Here's a 90-second marketing video.

Facilities

Imagine a college campus, but replace students with the 65+ crowd. Some include a pharmacy, a medical facility, concerts, multiple restaurants, lectures, and woodworking shops.

Curious? Read about my visit to a local CCRC.

Find a place

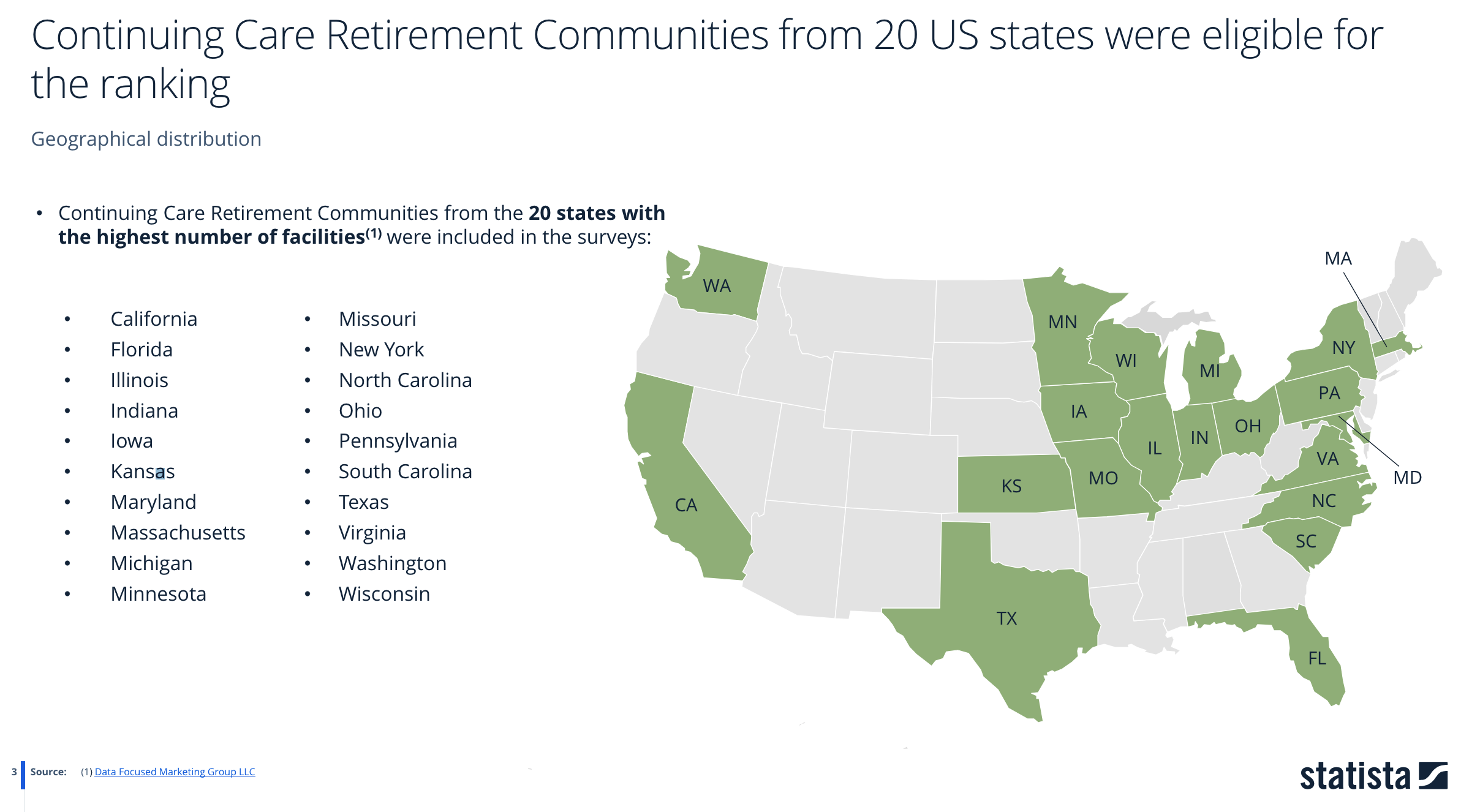

Newsweek and Statista publish their top 250 CCRCs in the US, but the list only includes units in 20 states (weird).

If you live in a state not on the above map, then no local CCRCs will appear on their top 250 list. 😕

myLifeSite, US News, and Caring.com are also good resources for searching CCRCs near you.

Costs

CCRCs are a big financial commitment. Most charge an entry fee (often refundable) and a monthly rate that usually includes your food, lodging, and activities.

Entry fees

Entry fees vary from $100k-$1m, average around $350k, and are typically paid for by the sale of your home. Most entry fees are 50-90% refundable to your family when you leave or pass away.

Plan types

Most CCRCs offer either a single plan or a choice among these three plan options.

| Plan | How it works | Entry fee and rate |

|---|---|---|

| Type A (all-inclusive care) | Unlimited care; Consistent cost | Higher |

| Type B (in between) | Limited care, then pay extra | Medium |

| Type C (à la carte care) | Pay for care; Unknown costs | Lower |

Some thoughts:

- Think of type A (all-inclusive) as a form of insurance, since they'll pay the bill for all of your long-term care. For example, if you need to change to nursing care, your monthly fees don't change.

- If you choose a type A (all-inclusive) plan, you take the risk that the facility will be around as you age. Some won't (see below).

- The plans are a tradeoff between cost and risk. If you pay less up-front (plan C), you risk paying more long-term care costs down the road.

Cost examples

Below are cost examples from two Erickson properties. Both are one-bedroom (1-person), but they feature two different plans (all-inclusive and à la carte care).

| CCRC | Entry fee | Monthly rate | Type |

|---|---|---|---|

| Devonshire, FL | $545k-$924k, 90% refundable | $5500+ | A (all-inclusive care) |

| Wind Crest, CO | $230k-$690k, 90% refundable | $2800-$3700 | C (à la carte care) |

Payment options

Most CCRCs are paid with personal savings or long-term care insurance.

- 🔴 Private health insurance doesn't cover CCRCs.

- 🔴 Medicare doesn't pay for CCRCs.

- 🟡 MedicAID only helps if you have a severe financial hardship or a disability, but options are often limited for CCRCs.

- 🟢 Long-term care insurance covers CCRCs (see below).

Long-term care insurance

Most long-term care insurance (LTCi) policies can be used with any CCRC plan, especially hybrids with cash indemnity benefits.

- Type A (all-inclusive): You receive care at no additional cost, eliminating the need for LTC insurance. However, if you already have an LTC insurance policy with cash indemnity, you'll still receive cash benefits when you need long-term care, which you can use for any purpose, such as leaving an inheritance for your family.

- Type C (à la carte care): If you own an LTCi policy, you can use your benefits for your long-term care like other senior communities (e.g., assisted living facility or nursing home).

Lifetime promise

Memory care can extend for 10-20 years and be prohibitively expensive. But what happens if you're in a Type C CCRC (à la carte care) and the cost of this extended long-term care wipes out your assets?

Typically, CCRCs first draw down your entry fee. Once this is exhausted, some will require you to leave, while others offer a life commitment of care (more common in non-profit CCRCs).

CCRCs can fail

Since 2020, 14 CCRCs have filed for bankruptcy (WSJ, subscription required), including one in Michigan, putting residents' entrance fees at risk.

Many of these bankruptcies resulted from the COVID-19 pandemic as residents left group facilities or passed away.

You have many choices, and a CCRC is a huge investment, so it's a good idea to research all options thoroughly before you or a loved one joins.

Research

Take tours of CCRCs near you. Many offer a complimentary lunch. Attend presentations. Ask questions. Record your notes.

You can also do a lot of research online:

- Download a CCRC consumer guide from CARF, an accrediting organization.

- Review myLifeSite to compare CCRCs side-by-side for amenities, finances, size, and more.

- Get their financial reports. If a CCRC is a non-profit, download their public tax records. Otherwise, check the about section on their website or request the reports from the CCRC (not all provide them).

- If you're a fan of numbers, watch this video or download this report from CARF on CCRC financial ratios. 🤓

- Ask a CCRC for their occupancy rates. Ask questions of management if their rates are far below the 91% average as of 2024.

- If you still have questions, ask an eldercare lawyer to review their documents for you.

Getting in

Many CCRCs (especially non-profits) have 5-10+ year waiting lists. You can often put down a $1,000 refundable deposit to hold your spot in line when vacancies open up.

Once a spot opens up, you can accept or delay your decision. If you accept, your CCRC needs to know if you can afford to pay your bills over the long term.

- Financial - When you apply (and periodically when you're a member), they'll look at your assets, monthly retirement income, and LTCi benefits.

- Health - Some CCRCs only admit residents who can initially qualify for independent living, as their costs will be lower for a number of years.

Once you pass their financial and health screens, you're in. Celebrate with hundreds of your best friends, jumping up and down with fists in the air.

Wrap up

Like the Avengers combining their unique powers, CCRCs offer a blend of support options - all in one place.

However, this super-team approach isn’t for everyone. Many people prefer to age at home, and CCRCs can be more costly than other options.

But for those who can afford it, CCRCs provide the peace of mind that care needs will be met as they evolve, all without constant moving. Residents also rave about the social connections and active lifestyle these communities foster.

If a CCRC feels like the right fit, keep researching and asking questions—finding the perfect community could be your own superhero move toward a secure, fulfilling future.

This Reddit post provides a good first-hand account of how CCRCs work.

Comment

byu/Rough-Fix-4742 from discussion

inretirement